In October, we invite you to join our exciting investment journey on Kangaroo Island, where a premier golf course project awaits your investment. Explore the NFP round table series, offering invaluable insights into the non-profit sector. Dr John Price gives exclusive insights into the current market volatility and how we can use mathematics and science as well as the Conscious Investor Fund to see behind the curtains. Stay updated with industry trends and economic outlooks to navigate the financial landscape effectively. Let TIP Group be your guide in the world of finance.

TIP Group NFP Round Table Series

In our TIP Group news, we're excited to share the success of our recent round table networking session series on Not for Profit's (NFP).

These sessions provide an invaluable opportunity for all, regardless of experience, to learn from seasoned professionals in the NFP sector.

At these sessions we have been exploring:

- Identifying a clear mission and purpose

- Governance and leadership

- Funding and revenue

- Transparency and accountability

- Programs and services

- Volunteerism and engagement

- Regulatory compliance

- Challenges and opportunities

- Impact measurement and evaluation

- Ethical considerations

- Advocacy and policy

- Success stories and best practice

We've already had one productive session, with three more insightful discussions on the horizon. The series will conclude with a lively cocktail party, fostering connections and knowledge exchange.

We invite anyone in the Sydney region to attend.

If you can't attend but want more information on running your own NFP, contact our Corporate Advisory Team or visit our Corinthian Balanced Fund that supports NFP's.

Corporate Advisory

We are thrilled to present an investment opportunity to be a part of an exciting development of one of the world's most remarkable destinations - Kangaroo Island, South Australia.

The Pennington Cliffs Property Trust offers a chance to invest in a range of dynamic property and tourism assets, including the awe-inspiring KI The Cliffs Golf Course- Australia's newest destination golf course designed by Darius Oliver.

The Pennington Cliffs Property Trust has already made significant acquisitions and investments in some of the island's leading tourism assets across the eastern end of Kangaroo Island, including the renowned Penneshaw Pub and Seafront Holiday Park, leaving this investment opportunity positioned for success. These ventures are funded, operating and profitable, ensuring a solid foundation for future growth. The management teams, staff, operating systems, and robust sales and marketing networks are all in place,

With a solid foundation already in place, this investment poses significant potential for future returns.

Key Assets:

- Penneshaw Pub: A well-established and popular pub on Kangaroo Island, providing a vibrant social hub for locals and tourists alike.

- Seafront Accommodation Pty Ltd: Offering a range of accommodation options, including the Seafront Hotel and Seafront Holiday Park, this asset caters to the diverse needs of visitors to Kangaroo Island.

- The Terraces: A leasehold property that presents an excellent opportunity for business operations and further development.

- The Cliffs Golf Course: This world-class golf course will be the centerpiece of the development, offering breathtaking views and an unforgettable golfing experience and expected to come online in early 2025.

As Kangaroo Island continues to attract tourists from around the world, the demand for high-quality accommodation, entertainment, and recreational facilities is on the rise.

By investing in the Pennington Cliffs Property Trust, you will not only contribute to the island's development but also position yourself to benefit from its future success.

Don't miss out on this unique opportunity to invest in Kangaroo Island's most promising venture. Join us in shaping the future of this remarkable destination by becoming a valued investor in the Pennington Cliffs Property Trust.

Retail Advisory

Ready for Retirement?

Retirement savings are not just about setting aside money for the future; they represent the key to financial peace of mind in your golden years. Building a substantial nest egg gives you the freedom to enjoy life after retirement and reduce your financial worries. This is where TIP Wealth can help.

At TIP Wealth, we recognise the importance of growing your retirement savings and effective planning for your retirement. Our financial planning services are tailored to help you navigate the complexities of investing and managing risk. To achieve this, we take a personalised approach, working closely with you to set achievable savings goals, optimize your investment strategies and manage your plan through regular reviews and ongoing support.

Our team is committed to guiding you through every step of the journey, from initial assessments to tailored investment plans. We take pride in helping individuals secure their financial future and make their retirement dreams a reality.

Don't leave your future to chance; let us be your trusted partner in building a stable financial foundation for the retirement you've dreamed of but feared you may not achieve. With our support, you can approach your retirement with confidence, knowing that your financial well-being is in capable hands.

For help with your retirement planning contact our Retail Advisory Team.

Mortgage Broking

Considering your financial options but unsure where to start?

In such a dynamic property market, it can be hard to navigate the ever-changing financing options available.

Let us assist you in reaching your goals and exploring your choices. As a broker, we can help with:

- First mortgages

- Renovation financing

- Refinancing

- Finance for property investments

Working daily with clients, our mortgage brokers stay updated on the latest mortgage products, lending practices, and policies - we're here to help steer you in the right direction to negotiate the right deal from the lenders.

Get in touch with our Mortgage Broking team today: Mortgage Broking

Economic Update

Market Update and Economic Outlook – October 2023

In September, August job numbers were released stating seasonally adjusted unemployment rate remained steady at 3.7%. This was in line with market expectations.

Philip Lowe in his last meeting as governor in September, pointed out that a recent increase in petrol prices, which is a key input for households’ inflation expectations, demonstrated that the process of returning inflation to target may be “uneven”’.

Inflation decreased to 4.9% in July driven by falls in the prices of fruit and vegetables as well as fuel. However, fuel prices increased sharply in August and this continued into September and this is likely to boost the headline inflation number for the September quarter. The stable result in August is tipped to support expectations of a prolonged monetary policy pause.

The outlook for the Chinese economy has also become more uncertain and the Australian economy may slow more sharply than expected. China accounts for around one-third of Australian exports and about half the demand in many of the commodities that Australia exports. The other key factor is that China determines the price of almost 100% of our exports.

Commonwealth Treasurer Jim Chalmers has acknowledged these risks, adding the Government is closely monitoring developments in China.

The latest retail sales and job vacancies data have also strengthened the case for a prolonged period of monetary policy pause. Retail sales fell for 3 quarters to 30 June 2023 and the August number is further evidence of a shift in consumer spending behaviour following a prolonged period of discretion. This low trend in growth highlights just how much consumers have pulled back in response to the cost-of-living pressures.

Job vacancies fell 8.9% for the three months to 31 August. The level of job vacancies is still high indicating a tight labour market, but they are now falling indicting the labour market is cooling.

The bulk of fixed mortgages mature by 31 December. Will consumers use savings to support spending which could keep strength in the economy for the short term or will consumers cut spending because their mortgage rate has gone up. The latter could result in economic slowdown.

Therefore, the spending of savings will be pivotal in determining when an economic slowdown might occur.

Stock Highlight

Data3 Limited (ASX: DTL)

Data3 Limited (DTL) provides information technology solutions which draw on their broad range of products and services and, where relevant, with their alliances with other leading industry providers. Data3 has built a reputation not only on technical excellence, but on engaging with customers and suppliers fairly and honestly.

Background:

- DTL is an Australian IT solutions provider that partners with major technology companies such as Microsoft, Cisco, HP, Dell, Lenovo, Adobe, and VMware. Its range of services includes cloud data centres, modern workplace solutions, cybersecurity, data analytics, IT networking, consulting and support services, software licensing, and asset management. The company has prioritised IT security and services for both the government and private sectors.

- DTL has been in operation since 1977, with headquarters in Brisbane and nine offices and three integration centres in Australia and Fiji. Its revenue in FY23 was $1.2B, and it employs over 1300 people, serving around 2000 customers. The company's customer base has scale and IT complexity, requiring extensive project design and consultation.

- DTL's revenue comes mostly from infrastructure and software solutions, which are high volume and low margin businesses. To increase margins, the company has a strategy to increase consulting, project, and support services. Approximately 66% of DTL revenue is now recurring, which includes software licenses and cloud-based SaaS provision.

- DTL's services are in high demand due to technological advances, the migration to cloud subscription services, COVID-19 work-from-home arrangements, and increasing concerns about cybersecurity. The company is well-positioned to take advantage of these trends, and its focus on IT security has helped it secure contracts with government agencies and private businesses.

Moats:

- Top level accreditations with key suppliers

- Low-cost provider

- Approved supplier on Government panels

- Have recruitment and training business providing best candidates to DTL

- Trap door moat encumbrancy Potential

Future Risks:

- Hack causing loss of client confidential data

- Major technological change disrupts their business

- Loss of major Government contract

- Microsoft and others decide to go direct

- Microsoft and others adversely change commission structure

- ATO charges Microsoft with transfer pricing nullifying the value of using DTL as the intermediary

- Key people risk

Shareholder updates

Icon Metal

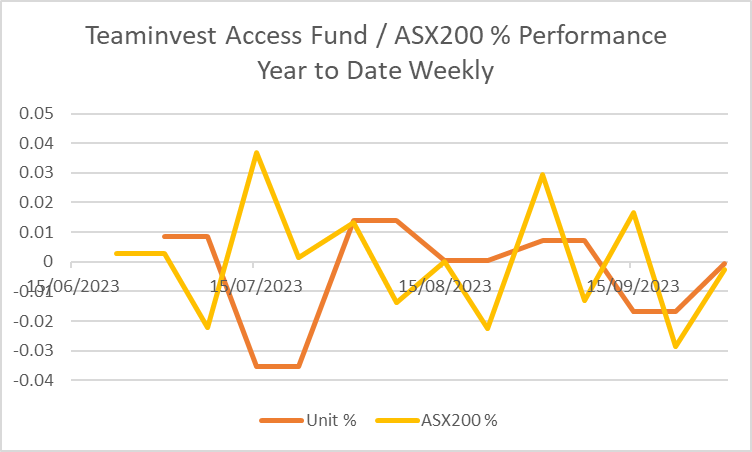

Teaminvest Access Fund

Unit Pricing

15 September 2023 $0.8946

30 September 2023 $0.8839

Fund Information

September is typically a bad month, and it proved true again this year. September saw the fund return a negative -1.94% compared to a negative return for the S&P/ASX 200 (Accumulation) Index of -2.84%.

Teaminvest Access Fund YTD performance is 1.37% vs S&P/ASX 200 (Accumulation) Index of -0.77%.

TIP Wealth Investment Management has a focus on reducing volatility through investing in high yield commercial property debt together with Australian equities to drive growth. This asset allocation has led to outperformance by the fund with reduced volatility.

Statements

Recently the following Statements have been issued:

- Annual Statements 30 August 2023

- Annual Tax Statements 07 September 2023

- Quarterly Statements 09 October 2023

Please check your Spam folder if they have not entered your email inbox. Alternatively, you may access your Investor Portal for a copy, using the following link: Investor Portal

Moving forward we are moving to Quarterly Statements. Therefore, monthly Statements will no longer be issued. The Quarterly Statement for the period 01 July 2023 to 30 September 2023 was issued 09 October 2023. The next Quarterly Statement will arrive in your email Inbox mid January 2024.

Investor Portal

If you have not logged into the portal, or are unable to access your Investor Portal, please do not hesitate to contact the Fund Administration Team on 1300 160 803 or email funds@tipgroup.com.au The Fund Administration Team will issue a new temporary password together with steps advising how to access your Investor Portal.

The Investor Portal gives access to:

- all relevant Teaminvest Access Fund Forms.

- all emails issued to you with attached Statements.

- provides the current investment holding at the current Unit Price value.

Contact Us

Our Funds Administration Team are here to assist.

(P): 1300 160 803

(E): funds@tipgroup.com.au

*Past performance is not indicative of future performance

Private Equity Fund

The TIP Wealth Private Equity Fund paid its inaugural distribution for 30 June 2023 to investors of 9.35 cents per unit which is a distribution yield of 6.85%.

Future Property Fund

Corinthian Balanced Fund

Unit Pricing

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

• The financial year starting unit price for the CBF is $1.00166 (ex-distribution price)

• The 30 September unit price is $1.013

• The performance for the month of September is 0.07%

• Financial YTD performance is 1.13% for the first three months

Portfolio Update

For the month of September, we continued our gradual buy in strategy with all purchases being Australian shares to a value of just under $488,000. We increased holdings in the following companies:

- ARB

- CSL

- CTD

- DTL

- FPH

- NHF

- RMD

- SUL

The main increases were for FPH ($139k); CSL (75K) and CTD($70k) as we took advantage of price weakness.

We added Super Retail Group (SUL) to the portfolio.

As of 30 September we have deployed circa $5.9m into equities with a current value of $5.95m.

Market Summary

September is typically a bad month, and it proved true again this year.

In Australia the S&P200 index fell 3.51% while in the US the S&P500 index fell 4.9%, its worst month since December 2022.

Calendar year to date the S&P200 is flat at 0.14% while the S&P500 is up 11.7%.

Conscious Investor Fund

Hello Members and interested parties of the Conscious Investor Fund:

Currently there is increased volatility in the share market. This is linked to an increase in the number of extreme statements in the press and media about the economy and the market. In this letter I will show how we use proprietary mathematics to see behind this volatility. When we do that, we will see we are provided with even better opportunities for the continuing success of the Conscious Investor Fund and hence for you, its Members.

Mathematics and Science

My background is as a mathematician and a scientist. The mathematics part means when I approach a problem there are two steps: be clear about the goal and tackle it by decomposing into simpler chunks. Next the science part kicks in: I want to set up experiments to test the results.

How does this apply to the Conscious Investor Fund? Starting with its goal, in simple terms, it is to invest in companies that will have higher prices for many years … five years, ten years and more. Turning to the decomposition of this goal, how can we decompose the prices of these companies in such a way that we have a better handle on forecasting them? If we can do that, obviously we are going to be better investors. For confidence, we then test these conclusions.

The Conscious Investor Pricing Formula

To decompose share prices, in my book The Conscious Investor (Wiley 2011), I introduce the formula:

Share Price = Earnings per Share (EPS) x P/E Ratio

It decomposes the share price into two parts, earnings per share (EPS) and the P/E ratio. (We now refer to it as the Conscious Investor® Pricing Formula.)

Let’s look at the two components starting with the P/E ratios.

P/E Ratios and Randomness

P/E ratios are continually moving up and down. Behind these fluctuations are the fluctuations of the prices themselves. No matter where they come from, studying movements such as these is something that mathematicians are very good at. (It is called signal analysis.)

The problem is that hundreds of mathematical studies using thousands of trading strategies show that share prices are essentially random. I say essentially since if P/E ratios are high, they tend to drift down. And if they are low, they tend to drift up. But when this will happen, and how fast it will occur, is like lying on your back as a child watching patterns in the clouds, it is unpredictable. The conclusion is that it is impossible to get consistent profits from trading methods using only price movements. (See The Conscious Investor for details.)

Growth of Earnings

According to the Conscious Investor Pricing Formula, this leaves us with EPS. We want companies for which we are very confident that EPS will be significantly higher in five, ten, or more years in the future. This is the role of the Fund’s Capital Allocation Team coupled with the number crunching of Conscious Investor using proprietary mathematical filtering functions. This is something we are very good at as you can see by the regular reports we distribute describing the growth of EPS for the largest companies in the Conscious Investor Fund. For companies to be included in the Fund they must pass the Conscious Investor mathematical filters in terms of stability, growth, debt and so on. Importantly, with a margin of safety. They must also pass Teaminvest criteria such as committed and exceptional management, strong economic moats, manageable risks, shareholder-focused incentives, et cetera.

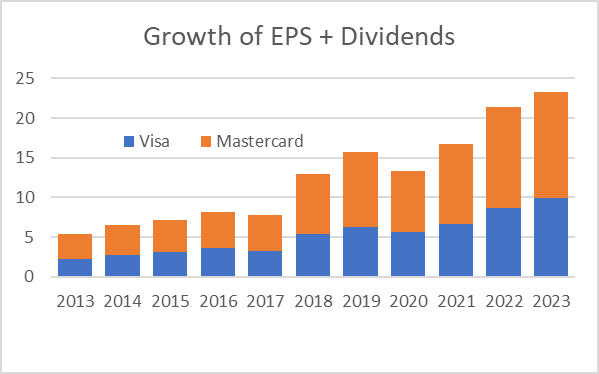

Example 1:

Here is an example of a pair of companies showing the type of growth of EPS we love: consistent growth year after year. It gives us confidence in their future. The companies are Visa and Mastercard which, from the perspective of users, are very similar. So we put them on the same chart. The data for each year is EPS plus dividends. Note the strong upward growth over the years.

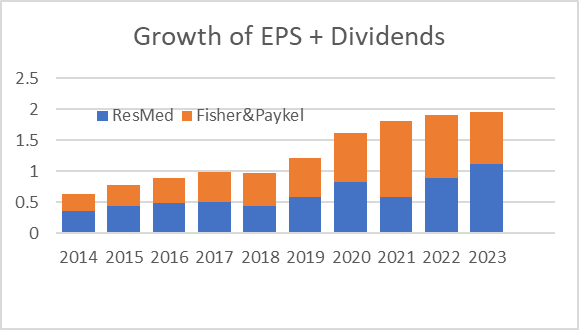

Example 2:

Here is a second example of a pair of companies showing consistent growth year after year. As for the previous pair, the data is for EPS plus dividends. This time the companies are Australian. They are ResMed (the Australian Stock Exchange listing) and Fisher & Paykel (using the Australian listing). Again, we put them together since they have considerable overlap in terms of their products and services.

Putting It Together

This completes the decomposition steps using the pricing formula. But, as a scientist, I want to verify the result. It should be that in broad terms, if EPS grows consistently over many years, we should see similar growth for prices allowing for the randomness of P/E ratios.

Specifically, if EPS grows by a certain percentage over an extended period, assuming that nothing major happens to the company, we would expect a similar growth to take place for total shareholder return TSR. The following table shows this is the case.

|

Company |

EPS Growth |

TSR |

|

Visa |

15.4% |

21.1% |

|

Mastercard |

16.2% |

25.7% |

|

ResMed (ASX) |

13.5% |

15.9% |

|

Fisher& Paykel |

15.7% |

21.8% |

What About Now?

As I said in the opening, in the markets today, statements are being made by analysts and reporters in the media that are even more extreme than usual. The market is going to head for record lows, we are going to have (or not have) a recession, interest rates are going to rise (or fall), unemployment will continue to rise (or fall), and so on. The good news is that none of this makes any difference to the quality of the companies we hold in the Conscious Investor Fund. Their earnings are likely to continue growing as usual.

There is, in fact, further good news. These press statements are likely to cause price drops in the short-term providing us with particularly attractive buying prices. This provides a welcome for new Fund Members and an opportunity for existing Members to top-up their holdings. As usual, clear thinking with mathematics and science on our side puts us in a strong position for continuing stellar performance of the Fund and hence for you, its Members.

This is a glimpse behind the scenes of part of how the Capital Allocation Team takes care of your money. If you would like to know more about the methods described above, my book The Conscious Investor (Wiley 2011) is a good place to start. It is available through most online book sellers, or through Amazon as a Kindle. If you need any help locating it, let me know.

With best wishes to you and your family.

Dr John Price

Founding Director of the Conscious Investor Fund

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, October 2023