NFP Practice

Maximising your impact for your cause

Upcoming Events

Strengthening your NFP

Property Management

Enhancing the potential of your property assets to generate returns and increase value.

Governance and Compliance

Mitigating organisational risks and strengthening governance and compliance.

Strategic Planning

Formulating strategic reviews and planning for the future.

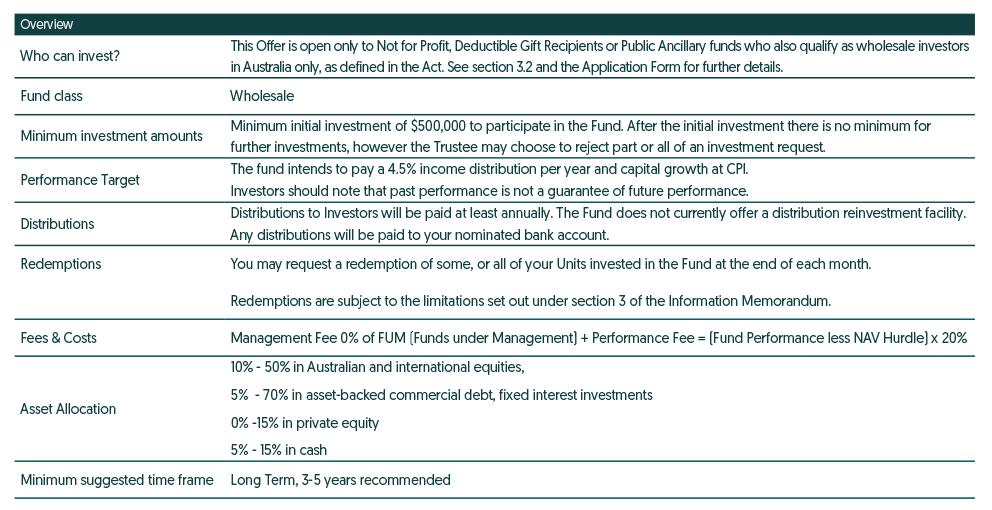

Funds Management

The Corinthian Fund is an unregistered managed investment scheme designed explicitly for not-for-profits and charities. The fund combines our long-running and highly successful Conscious Investor equities strategy investing in Australian and US shares with high-yield asset-backed commercial debt and off-market transactions. We know that every dollar we charge takes money from a charity's purpose, and, therefore, we are only paid if the fund achieves a compounding return above 6% per year. We put charities first.

Performance

Unit Prices Updated 31 July 2024

Unit Price 1.0916

FY23/24 8.93%

FYTD - 1.74%

Since Inception - 11.22%

*Performance is after all fees and costs

*Past performance is not indicative of future performance

Our Team

Michael Levenston, Principal

Michael is an accomplished corporate advisor with extensive experience in debt capital markets, business development, and credit. He has a proven track record of successfully structuring and negotiating deals with large financial institutions and is skilled in delivering outstanding results.

Sanjee Narendran, Head of Funds and Management

Specialising in Operations and Compliance Management – Sanjee is a Responsible Executive (RE) under the ASIC Market Integrity Rules, for both ASX Trading, and ASX Clearing and Settlements. He is also a qualified Equities and Derivatives Designated Trading Representative (DTR). Sanjee graduated in Business Administration having majored in Management and International Business with 10 years working experience in the Australian Stock Market, of which more than 8 years has been as a qualified DTR. His experience encompasses all aspects of trading in Cash Market and Derivative products.

Craig Wright, Head of Property Advice

Spanning 20+ years, Craig holds extensive experience advising investors across financial services, property development, real estate and PropTech.

He has held executive positions in national property development firms, with launch, management, and delivery responsibility on projects ranging in value from $20M to $550M.