Welcome to our February newsletter! We're excited to kick off with the release of our Interim Half Yearly Report, offering a detailed look at our recent performance.

Stay tuned for more updates and crucial economic trends.

TIP Group News

Interim Report now available - half-year ended 31 December, 2024

The six months ended 31 December 2023 (1H24) delivered further growth for Teaminvest Private Group Limited (TIP).

Reporting highlights include:

• Look Through EBITDA up 24% to $7.9m;

• Operating profit up 20% to $2.3m;

• Statutory Profit up 11% to $2.1m;

• Fully-franked interim dividend of 1.50 cents per share, 9% higher than 1H23; and

• Announcement of our first on-market buy-back to take advantage of our discount to net assets in line with the FY23 update to our capital allocation policy

The dividend includes the ability to participate in our dividend reinvestment plan (available on the ASX and our website).

Let us know your thoughts in the comments below.

Corporate Advisory

We are thrilled to welcome James Gallagher as the new head of our Corporate Advisory team.

With a dynamic career spanning professional sports and over 15 years in senior roles across Finance and Football, James brings a wealth of experience to the table. His proven ability to develop and implement strategies, manage a diverse range of stakeholders, and grow businesses will be invaluable to our team.

James' expertise will be instrumental in helping us continue to provide strategic advice and support to our portfolio companies, enabling them to develop as leaders and enhance their profitability.

Congratulations, James!

Retail Advisory

Financial planning is a crucial aspect of managing your wealth and securing your financial future.

Here are some key benefits:

- Goal Setting: Financial planning helps you clearly define your financial goals, whether it's buying a home, funding your children's education, or planning for retirement.

- Budget Management: It provides a structured approach to budgeting, ensuring you live within your means and save for the future.

- Investment Strategy: A financial plan guides your investment decisions, helping you choose the right mix of assets based on your risk tolerance and financial goals.

- Risk Management: Through insurance and other risk management strategies, financial planning helps protect you and your family from unexpected financial hardships.

- Peace of Mind: Knowing you have a plan in place to achieve your financial goals can provide peace of mind and reduce stress related to money matters.

- Wealth Maximisation: Effective financial planning can help maximise your wealth by identifying opportunities for growth and minimising tax liabilities.

Remember, a well-crafted financial plan is not a one-time event but a continuous process that requires regular review and adjustment as your circumstances change. Our team of experienced advisors is here to guide you through this process and help you make informed financial decisions.

Contact our Retail Advisory Team: Retail Advisory

Mortgage Broking

In its first meeting of the year, The Reserve Bank of Australia (RBA) has decided to again hold the official cash rate at 4.35%.

The decision to maintain the cash rate follows the release of data last week which showed the annual inflation rate is falling faster than expected.

This year, the RBA will decrease the frequency of their meetings from eleven to eight times per year.

Get in touch with our Mortgage Broking team today: Mortgage Broking

Economic Update

Market Update and Economic Outlook – January 2024

Equity Markets

The ASX200 advanced 1.18% for the month and the S&P500 advanced 1.59%.

The companies behind the “Magnificent 7” are the powerhouses driving the performance of the S&P500. The Magnificent 7’s performance has an outsized impact on the market as a whole. Five of these stocks (exclude Apple and Tesla) were responsible for a staggering 98% of the index’s gain for January.

The Magnificent 7 are: Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia & Tesla.

2023 – Rear View Mirror

2023 was a year of multiplicity. We’ve seemingly experienced central banks swinging, depending on your interpretation, back and forth between tightening to loosening all year.

We’ve also experienced AI booms, geopolitical ructions, and the continuing reversal of globalization. There has been a shift in the new world order. We can no longer rely on China to be a part of supply chains as China is grappling with its own problems.

For investors, interest rates and inflation remain front and centre. The speed of rate rises through 2022 and 2023 seem to have tamed inflation but it is not yet eradicated.

Some Learnings

• We saw bond yields rally and then decline

• Volatility provides opportunity. With volatility the market doesn’t truly understand the value of a company

• Sentiment was up and down for the year.

• Big surprises for 2023 –

- Consumer has hung in there much better than expected. Dispersion of spending with the young spending less due to rental costs for example. Black Friday sales were very large.

- Healthcare was negative – disruption due to DLP 1

- Central banks didn’t make mistakes? Set policy in lagging data – no major blow-up creating contagion.

- People were waiting for something to break – Silicon Valley bank – but it did not spread.

- Lithium turnoff in last few months

Dec Quarterly figures

• In Australia retail sales fell 2.7%. This followed a September quarter where consumer spending did not increase.

• In Australia CPI was 0.6% y/y 4.1%. Lower than expected.

• US economy expanded in Dec quarter.

Interest Rates

How opinion can change.

The talk late December spun from “when will interest rates next rise” to “how soon before they fall.”

This change was most prominent in the US, with the Fed Reserve expecting US interest rates to be lower by the end of 2024 and financial markets in Aus also suggested interest rates will fall over 2024.

Central banks are now adamant that rates will not move until inflation is lower. This position was reinforced by the RBA Govenor last week.

ECB left cash rates at 4.5% in January.

The BOE held its key rate at 5.25% as expected and dropped references to further lightening in its guidance.

Information & Investing

Information has never been as accessible, but you need to question the quality.

A lot of information relates to short-term macro-economic outcomes which predicting the outcome of is notoriously difficult.

Trying to predict short-term macro variables is hard because much is simply unknowable. As Warren Buffet stated – “What you really want to do with investments is figure out what’s important and knowable. If it’s unimportant or unknowable, you forget about it.”

In an at your fingertips and immediate world patience is a forgotten skill but is extremely important in our investment philosophy.

What to focus on? Fundamentals because they drive asset prices in the long run. A quote from the late Charlie Munger – “The big money is not in the buying or selling, but in the waiting”.

We use noise to our advantage as we are well prepared in knowing what we believe an asset is worth.

With reporting season upon us negative reactions to information can provide us opportunities to buy quality stocks at our preferred price.

Stock Highlight

Mineral Resources Limited (ASX: MIN)

Mineral Resources Limited (MIN) is a mining services company with a portfolio of mining operations across lithium and iron ore. MIN has been providing safe, high-quality, low-cost mining, mining construction and mining infrastructure services in Australia. The business consists of three core pillars Mining Services, Commodities and Innovation and Infrastructure.

Success built on Mining Services arm – Build Own Operate model for clients. Revenue doubles every 5 years or so. Regardless of performance of other pillars of business the Mining Services operation is very successful. Have a modular system (can be dismantled and moved) with a lot of IP and is best of breed. Very quick to build, low cost to maintain. Contracts with Hancock and RIO. MIN has been opportunistic in its iron ore mining operations. Has picked up mines near end of life at cheap prices.

MIN is nimble: can shut mines down and reopen according to commodity price fluctuations. Now aiming to be a low-cost iron ore miner ie 4th after BHP, RIO and FMG. Ramping up production to 90m tonnes pa. All-in cost reduction to $35 to $40 per tonne (62% fines). This includes the depreciation and amortisation of plant and operations (ie non-cash components). May not include cost of paying royalties to WA Govt – another $2 per tonne. There is still a lot of profit in iron ore at that cost. Price for Iron ore can fall significantly and there is still a good profit for MIN.

Shareholder updates

Icon Metal

Take a look at the remarkable project currently underway by our associated company, Icon Metal!

Sydney Childrens Hospital Project

They've expertly handled 15 tons of steel to build a crucial link bridge for the Sydney Children’s Hospital. Ingeniously overcoming their workshop's space limitations, they've split the 22m bridge into two manageable components. The initial 13m section is now prepped for priming and painting.

Kudos to the team for their exceptional work!

Teaminvest Access Fund

The unit prices for January 2024:

|

15th January 2024 |

$0.9298 |

|

31st January 2024 |

$0.9430 |

Fund Information

The TeamInvest Access Fund is still significantly outpacing the ASX 200 Accumulated.

|

Fund |

1 Month |

3 Months |

6 Months |

12 Months |

|

ASX 200 Àccumulated |

1.19% |

13.99% |

5.79% |

7.09% |

|

Teaminvest Access Fund |

1.37% |

10.00% |

5.50% |

9.061% |

The table above shows the comparative rolling results of the TeamInvest Access Fund and the ASX 200 Accumulated as of January 31, 2024. In the past 12 months, the Teaminvest Access Fund has significantly outpaced the ASX 200 Accumulated index.

The top 5 performing stocks within the TeamInvest Access Fund for January are highlighted below:

|

Share Code |

Share Name |

Return from 31/12/23 to 31/01/24 |

|

CSL |

CSL Limited |

5.25% |

|

DTL |

Data#3 Limited |

15.88% |

|

NHF |

NIB Holdings Ltd |

10.15% |

|

CCP |

Credit Corp Group Ltd |

6.17% |

|

JBH |

JB Hi-fi Ltd |

7.84% |

Distribution

A distribution for the first half of FY23/24 was announced and issued 25 January 2024. Distribution statements have been issued to your email inbox. If you haven't received your distribution statement, please check your spam folder. The statements can also be located within your Investor Portal.

Investor Portal

If you have not logged into the portal, or are unable to access your Investor Portal, please do not hesitate to contact the Fund Administration Team on 1300 160 803 or email funds@tipgroup.com.au The Fund Administration Team will issue a new temporary password together with steps advising how to access your Investor Portal.

The Investor Portal gives access to:

- all relevant Teaminvest Access Fund Forms.

- all emails issued to you with attached Statements.

- provides the current investment holding at the current Unit Price value.

Contact Us

Our Funds Administration Team are here to assist.

(P): 1300 160 803

(E): funds@tipgroup.com.au

*Past performance is not indicative of future performance

Private Equity Fund

The Private Equity Fund is a specialised wholesale diversified fund catering to investors who are seeking opportunities beyond traditional markets.

Leveraging over 20 years of financial wisdom and investment acumen, the fund offers a unique pathway into the often-untapped potential of Australian small to medium-sized enterprises.

Investing in our Wholesale Private Equity Fund means you are not only venturing into a diversified portfolio of growth investments but also aligning with a sophisticated investment strategy designed for discerning investors.

Unit Pricing update

Unit price is at $1.3650 at of 31 December 2023

Learn more about our Private Equity Fund

*Past performance is not indicative of future performance

Future Property Fund

Our Approach to Sustainable Housing and Working Spaces

The Future Property Fund is committed to delivering sustainable housing and working spaces for the benefit of investors and the community. Our noble purpose is to invest in the development and renovation of Australian property, providing outstanding investor returns while offering sustainable, tech-enabled solutions for work, home, and play.

Our approach is unique and forward-thinking. We target investments in the construction of new commercial and residential buildings that aim to be truly regenerative in nature. This means we focus on projects that not only provide a return on investment but also contribute positively to the environment and society.

We adhere to the living building challenge, which consists of seven performance categories or "petals": place, water, energy, health + happiness, materials, equity, and beauty. Each petal is subdivided into imperatives, creating a comprehensive framework that can be applied to almost every conceivable building project.

Our investment criteria are stringent. We ensure alignment with our noble purpose, provide an appropriate return for the level of risk to investors, and improve the quality and sustainability of real property for the benefit of users and the broader Australian society.

In essence, the Future Property Fund is not just about financial returns. It's about creating a sustainable future for all, one property at a time.

Learn more about our Future Property Fund here.

Corinthian Balanced Fund

January 2024 Update

- As of 31 January 2024, the unit price of the CBF was $1.0619, with a performance of 1.617% for the month and 5.944% financial year-to-date.

- The fund continues to have a higher allocation to cash than desired, but it was significantly reduced during the month of January with an investment into a property unit trust of $6.5mil.

- The CBF has a total portfolio value of $64,468,870 with growth assets accounting for $27,125,521 and defensive assets accounting for $37,343,349.

- The fund has continued to make strategic investments in shares, commercial debt, and a significant investment of $6.5mil in SBS Mortgage Series 1 Trust.

- Stock markets had another strong month with the ASX200 rising 1.18% and the S&P500 rising 1.59%. These rising markets again resulted in limited buying opportunities, but we continue to be patient.

Unit Pricing

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

• The financial year starting unit price for the CBF was $1.00166 (ex-distribution price)

• The 31 January 2024 unit price is $1.0619

• The performance for the month of January was 1.617%

• Financial YTD performance is 5.944% (for 7 months)

Portfolio Update

For the month of January there were limited opportunities to purchase stocks at preferred prices. We added circa $175,000 to the Australian shares with increased holdings in the following companies:

- AX1

- RMD

- TNE

The main increase was in TNE circa $119,000 as we took advantage of favourable buy-in prices.

*Past performance is not indicative of future performance

Conscious Investor Fund

Welcome to the interim Letter for members of the Conscious Investor Fund, families and friends:

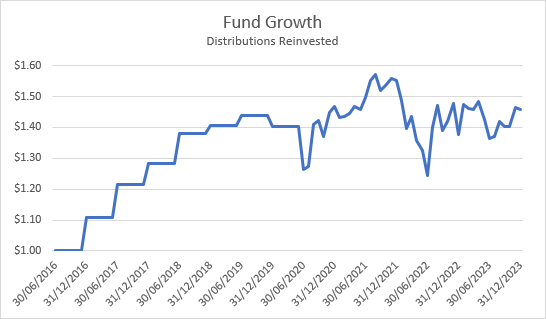

Over the past 12 months the performance of the Fund was 16.29%. Since inception, the investments of our early Members have tripled in value since they were first deposited. (You can see this in the growth chart in the Report.)

The Letter also takes a deep dive into Alphabet (Google) one of our largest holdings: what drives it with the sort of success that makes it likely we will want it to be a key holding for many years to come. Since 2015 the Fund has purchased 22 parcels of Alphabet shares for a current holding of 52,000 shares for a total value of AUD$11.6 million. This means an average annual return of 23.18% since the first purchase.

We also look at some of the penetrating remarks and quips by Charlie Munger, Warren Buffett’s late friend and partner, who passed away in December last year at age 99 years.

We wish health and wealth for you and your family for 2024. Let us know if you have any questions.

From John Price and Members of the Capital Allocation Team.

Dr John Price

Conscious Investor Fund

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, February 2024