Welcome to November's newsletter! Don't miss out on learning about our Conscious Investor Software which empowers our investments, our unique Corinthian Balanced Fund, specifically designed for NFPs as well as insightful updates on other funds and aspects of our services.

TIP Group News

Embracing AI: TiP Group's Partnership with BizGPT

TiP Group is excited to announce our strategic partnership with BizGPT, a leading artificial intelligence (AI) model. This partnership represents a significant step forward in our commitment to leveraging cutting-edge technology to enhance our operations and deliver superior results for our clients and shareholders.

Our collaboration with BizGPT has revolutionized many aspects of our operations. The AI model's ability to automate routine tasks has increased our efficiency, allowing our team to focus more on strategic decision-making and providing exceptional service to our clients. From drafting reports to generating insightful content for our newsletters, BizGPT has proven to be an invaluable asset.

As partners in BizGPT, we are not just users of this technology, but active contributors to its development and evolution. We believe that embracing AI and other technological advancements is key to staying competitive in today's dynamic and fast-paced investment landscape.

We look forward to sharing more updates about our partnership with BizGPT and our ongoing digital transformation journey in the coming months.

Follow the BizGPT journey on their social media:

Corporate Advisory

Do you sit on a board of a charity or a not-for-profit organisation?

The Corinthian Balanced Fund, managed by TIP Wealth Investment Management, is a unique financial instrument that has been making waves in the not-for-profit sector. This fund is designed with a distinctive approach that aligns the success of the fund managers with that of the investors.

A Unique Fee Structure

The Corinthian Balanced fund is only open to not-for-profits, charities, and public ancillary funds. We put charities first with zero ongoing management fees and a performance fee that incentivises our team to deliver a compounded return above 6% per annum.

This innovative approach ensures that the fund's success is directly tied to the success of its investors, creating a shared sense of achievement and financial growth.

Conscious Investor Software: A Strategic Approach to Investment

The Corinthian Balanced Fund utilises our proprietary Conscious Investor software to select investments. This advanced tool allows us to make informed decisions based on a range of factors, ensuring that we choose investments that align with our fund's objectives and our investors' goals.

As both the trustee and the manager, we are equipped to handle off-market or unlisted assets, which are often essential for many charities’ management needs. Our investments encompass Australian and US shares, high-yield asset backed commercial debt, and off-market transactions, all aimed at delivering regular income.

A Significant Investment from Masonic Charities Trust

Recently, the fund received a significant vote of confidence from the Masonic Charities Trust, a not-for-profit organisation. The trust has invested a substantial $70 million into the Corinthian Balanced Fund, demonstrating their belief in the fund's vision and approach.

Looking Ahead

As we move forward, the Corinthian Balanced Fund continues to strive for a balance between financial returns and charitable objectives. We invite you to learn more about this unique fund and how it is changing the landscape of investment for not-for-profit organisations.

For more information, visit our Corinthian Balanced Fund page or contact our team today.

Retail Advisory

Enva's Family Shield: Your Financial Safety Net

A Blend of Administration and Advice

In today's complex financial landscape, Enva's Family Shield Services stand as an extra level of security. This low-cost service offers a blend of financial administration and general advice, tailored for individuals and families.

Robust Fraud Monitoring

You can call or email our team to ask us to investigate a phone call or email - we will find out if it's real, and if it's not, we will report it for you.

No need to risk your computer being infected or losing sleep because maybe it was the ATO. Just ask us, and we'll check it out.

Simplifying Financial Products

Family Shield goes beyond just security. It simplifies the complexities of financial products like superannuation wrap accounts and retail insurance contracts. With our team's support, you can navigate these products without the need for an expensive adviser.

Crisis Support

In times of crisis, Family Shield extends its support even further, offering assistance with essential documents and liaising with accountants, lawyers, and government departments.

We can hold copies of your will, work with your accountants, lawyers and even government departments to help if you need it.

We hope our clients never need this service, but as a family shield member, this assistance extends to parents and children of our clients.

Your Financial Safety Net

Enva's Family Shield is more than a service; it's your financial safety net.

Learn more here: Family Shield

Mortgage Broking

Following four consecutive monthly pauses, The Reserve Bank of Australia (RBA) has raised the official cash rate by 0.25%. to 4.35%.

The decision to increase the cash rate follows the recent release of higher than anticipated September 2023 quarter inflation numbers.

Get in touch with our Mortgage Broking team today: Mortgage Broking

Economic Update

Market Update and Economic Outlook – November 2023

The months of September and October, after a period of relative stability, were quite volatile with the ASX S&P 200 Index ending down 3.8% in October, after falling 3.51% in September.

Following the large fall in September the S&P500 fell a further 2.2% in October.

Calender year to date the S&P200 is down 3.67% while the S&P500 is up 9.23%.

ASX Reporting season

In October each year, listed Australian companies with a June financial year end host their annual general meetings (AGMs).

This October has seen greater interest in company updates at the AGMs due to the sharply changing economic conditions. Over the last 18 months, the average mortgage rate has increased from 2.14% to 6%, along with cheap fixed-rate mortgages converting into higher variable rates dubbed the “fixed rate cliff” by the media. This should have seen cratering retail sales in 2023 and significant falls in house prices, neither of which have occurred. Additionally, increases in inflation of the same period have posed challenges for many companies.

Looking at JB-HiFi. First quarter was much better than expected, with Australian sales falling -1.4%, cycling off a very strong first quarter last year. They appear to be benefiting from their lower cost business model, and are likely to be taking market share off Harvey Norman which saw sales drop by 14%.

Healthcare Robust, but weight loss fears dominate

The past quarter has been tough for investors in healthcare stocks, with the dominant theme being concerns that GLP-1 weight-loss drugs will impact demand for a range of therapies treating sleep apnea, cardiovascular diseases and kidney damage. Indeed, these weight loss drugs have even impacted the share prices of pathology testing companies under the assumption that a potentially slimmer society will result in fewer oncology, fertility, gastrointestinal and respiratory tests.

Resmed has seen its share price hit the hardest, losing a third of its market capitalisation due to the view that slimmer patients will see diminished demand for sleep apnea devices. Our view is that this demand reduction is being overstated and there is still good long- term growth potential for the company. Resmed’s quarterly update showed revenue of +16% and profits up +9%.

Similarly, CSL’s share price has been under pressure due to the unproven potential of the GLP-1 weight-loss drugs on the company’s kidney disease treatments, despite dialysis comprising a small part of company earnings. At their annual capital markets day in October, CSL revealed that the company was trading strongly and confirmed guidance for profit growth in 2024 between 13-17%.

Take Out

Global equity markets have fallen by close to 10% over the last three months, and at the close of October 2023, many companies on the ASX200 are trading near or even below the lows of March 2020 despite having better business operations and higher profits in 2023.

Toll road operators Transurban and Atlas Arteria are trading at a 25% discount to their pre-COVID share price despite higher traffic volumes and toll prices. Similarly, healthcare companies Sonic Healthcare and CSL both have share prices below January 2020 despite having higher earnings per share and servicing more customers worldwide.

While some companies will struggle in an environment where money is no longer free or falter due to higher geopolitical tensions, for many companies, these factors will have limited to no impact on corporate profits and distributions to their shareholders.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine” – Warren Buffett.

Economy

For some time now, the market consensus has been that long term interest rates were near their peak as inflation, while still high, was coming down. That premise partially unravelled over the past two months and, as a result, we saw the US 10-year Bond and the Australian 10-year bond both rise significantly in yield and equity markets sell off.

The thinking now is that inflation has likely peaked globally but the rate of its descent has been pushed out. It is that speed of descent that markets are currently debating, and it remains an open question whether central banks have done enough in tightening financial conditions or more is required in taming inflation. Until this is clear, market volatility is likely to remain, and this can be unsettling.

Outlook for Oil

Movements in the price of oil have a significant effect on the economy. An increase in the oil price both adds to inflation and suppresses economic activity, two effects that could be particularly damaging in the current economic environment.

While shocks to actual or expected supply, such as from Russia’s invasion of Ukraine, have an important impact on the oil price, as the past few years have highlighted, movements in demand can be a bigger driver of the oil price. In recent years China has accounted for much of the global growth in demand for oil.

A slowdown in economic activity globally over the next 1–2 years from tighter monetary policy (and higher inflation) could ease demand for oil and put downward pressure on the oil price.

Other dynamics are the focus on the impact of events in the Middle East and the United States’ Strategic Petroleum Reserve (SPR).

Following the attack on Israel the price of oil rose $4/barrel compared to the rise of over $20/barrel when Russia invaded Ukraine.

The SPR was established in response to the 1970s oil embargo to protect the United States given at the time it was a net importer of oil (it is now a net exporter). The size of SPR holdings was reduced gradually from 2017 to 2021 in response to high oil prices. Large withdrawals were authorised by the President from March 2022 following the invasion of Ukraine and resulting jump in prices. Once the oil price had fallen back below $80/barrel in late 2022, SPR withdrawals ended.

While the SPR is currently only half of its full capacity, the United States could release some oil in response to a jump in the oil price from an escalation of the Hamas-Israel war.

Stock Highlight

Breville Group (ASX: BRG)

Breville Group (ASX: BRG) is an Australian designer and distributor of small kitchen and home appliances to more than 70 countries.

The company's brands include Breville, Kambrook, and Ronson.

In the UK and Europe, the company's products are marketed under the Sage brand.

The vast majority of Breville's revenue comes from the firm's global product segment. The company's distribution segment sells products designed and developed by third parties under Breville-owned brands or third-party brands such as Nespresso.

The company acquired air and water purifier specialists Aquaport and Cli-mate, as well as coffee grinder brand Baratza.

In 2022, BRG Group acquired Italian based coffee group, LELIT who design, manufacture and market premium prosumer home coffee equipment in Europe and throughout the world.

Conscious Investor overview as at 6 November 2023:

Commentary:

· Breville Group generate revenue mainly through selling premium products. Breville and Sage (UK brand as the name Breville is taken) are their premium brands. Kambrook is a generic brand and is used mainly in Australia and NZ.

· They have moved towards a solution-based model and see themselves as a "Virtual IP Company” responsible for information management and IP creation, go-to-market strategy and management.

· The remainder is outsourced: an asset-light company that:

- designs and engineers market-leading products, and

- manages the sale and support of those products by aligning with third parties worldwide.

· Value-added offering with their IT strategy: connected devices.

· The payout ratio has declined over the last few years: it was planned due to R&D, expansion overseas and acquisitions.

· ROE has also reduced due to acquisitions. increased stock levels and the resulting debt

· Headwinds in the industry: less discretionary spending due to cost of living impacts on consumers.

· BRG has lots of competition and is the 14th largest company among its peers.

· Marketing is important and contributes greatly to their results.

Moats:

· Organic eco-system

· Brand recognition

· IP and technology

· Reliable global supply chain and distribution

· Management systems and remainder outsourced.

· R&D ~12% of revenue

· Third-party manufacturing and distribution: i.e. Nespresso

Potential Future Risks:

· Supply chain impact

· Manufacturing disruption

· Adverse regulatory decision – e.g. US tariffs

· Cyber hacking i.e. IP stolen

· Loss of design capacity - key people

· Product failure

· Loss of significant contract i.e. failure to maintain inventory management

· Dominant shareholder adverse action

Shareholder updates

Graham Lusty Trailers (GLT)

We are delighted to share an inspiring article from Shay Chalmers, the new CEO at one of our portfolio companies, Graham Lusty Trailers. Shay, with her accomplished global background in engineering management, is driving GLT towards a future of innovation, expanded market presence, commitment to sustainability, and unwavering dedication to their customers.

The write-up sheds light on GLT's exciting plans ahead under Shay's direction - including, enhanced manufacturing practices, a focus on safety, and a continued dedication to service beyond manufacture. We invite you to read and join the journey on their social media platforms.

A New Chapter Unfolds at GLT | Graham Lusty Trailers

Teaminvest Access Fund

Unit Pricing for October 2023

15th October 2023 $0.8838

31st October 2023 $0.8573

Fund Information

The months of September and October, after a period of relative stability, were quite volatile with the ASX S&P 200 Index ending down 3.8% in October, after falling 3.51% in September.

The Access Fund’s return for the month was negative -3.1% compared to a negative return for the S&P200 (Accumulated) index of -3.78%.

Financial YTD performance is negative -1.67% v ASX S&P200 (Accumulated) negative -5.079%.

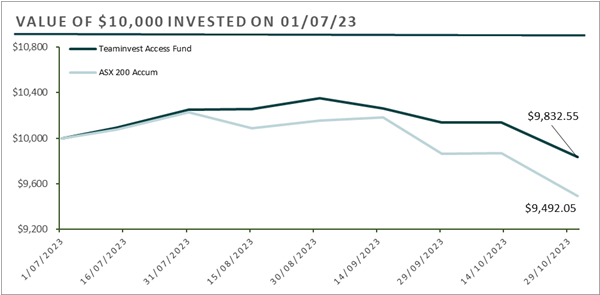

The ASX-200 Accumulated, and the Teaminvest Access Fund have experienced a decrease in returns over the past few months, following a robust start to the fiscal year. If an investment of $10,000 had been made in each of these funds, the current balance would be $9,492.05 for the ASX-200 Accumulated and $9,832.55 for the Teaminvest Access Fund. The Teaminvest Access Fund has controlled losses to less than the market.

In the current composition of the fund, Consumer Cyclicals represent the largest equity segment. This is followed, in order, by Healthcare, Financials, Technology, and Consumer Non-Cyclicals. Please note that the allocation can change based on market conditions.

Investor Portal

If you have not logged into the portal, or are unable to access your Investor Portal, please do not hesitate to contact the Fund Administration Team on 1300 160 803 or email funds@tipgroup.com.au The Fund Administration Team will issue a new temporary password together with steps advising how to access your Investor Portal.

The Investor Portal gives access to:

- all relevant Teaminvest Access Fund Forms.

- all emails issued to you with attached Statements.

- provides the current investment holding at the current Unit Price value.

Contact Us

Our Funds Administration Team are here to assist.

(P): 1300 160 803

(E): funds@tipgroup.com.au

*Past performance is not indicative of future performance

Private Equity Fund

Risk Management in Our Private Equity Fund

At TIP Group, we understand that investing in private equity involves a unique set of risks. That's why we have a robust risk management framework in place to identify, assess, and manage these risks, ensuring the best possible outcomes for our investors.

Our Process

Our risk management process begins with the Investment Committee. This team of experienced professionals conducts a thorough analysis of every potential investment opportunity. They scrutinize the financial health of the company, the market conditions, and the potential for growth. This rigorous due diligence process helps us avoid investments that carry an unacceptable level of risk.

Once an investment is made, the TIPReps and Strategy Committee play a crucial role in ongoing risk management. They monitor the performance of our investments, keeping a close eye on financial indicators, market trends, and company performance. If any potential risks are identified, they work closely with the company's management team to mitigate these risks and protect our investment.

In addition to these measures, we also believe in the power of diversification as a risk management tool. By investing in a diverse range of companies across different sectors, we can spread the risk and increase the potential for returns.

We also understand that risk management is not just about avoiding potential losses. It's also about identifying opportunities for growth. That's why our team is always on the lookout for strategic opportunities to increase the value of our investments, whether through operational improvements, strategic acquisitions, or market expansion.

At TIP Group, we are committed to managing risks effectively to protect and grow our investors' capital. If you have any questions about our risk management practices or if you're interested in learning more about our Private Equity Fund, please don't hesitate to reach out to us at info@tipgroup.com.au or learn more here.

Future Property Fund

Meet the Team behind the Future Property Fund

At the heart of the Future Property Fund is a team of seasoned professionals with a wealth of experience in funds management, property development, and investment. Their combined expertise is the driving force behind the fund's success.

Craig Wright, the CEO of Future Property Fund, brings over 20 years of experience in advising investors across financial services, property development, real estate, and PropTech. He has held executive positions in national property development firms, managing projects ranging in value from $20M to $550M.

Andrew Coleman, CEO/Executive Director of Teaminvest Private and Director of TIP Wealth Future Property Fund, is a co-founder of Teaminvest Private. Prior to joining Teaminvest Private, Andrew worked as an investment banker for Credit Suisse in Sydney, advising clients on significant corporate deals in Australia and internationally. He holds a Bachelor of Economics with Joint First Class Honours in Economics and Finance from the University of Sydney.

Dean Robinson, CFO of Teaminvest Private, oversees the company's financial strategy and operations. Before joining TIP, Dean worked as a Director of Mergers and Acquisitions with KPMG, leading the growth and development of the Greater Western Sydney team. He holds a Master’s in Applied Finance from Macquarie University Applied Finance Centre and a Senior Executive MBA from the University of Melbourne.

Michael Baragwanath, Head of Wealth and Investment Banking at Teaminvest Private, has over 16 years of experience in financial advisory, licensing, and large-scale project consulting in Australia, Dubai, and Hong Kong. Michael is responsible for the TIP Group’s advisory, funds management, licensing, and asset management operations.

Each member of our team brings a unique set of skills and experiences, contributing to the robust and diverse expertise of the Future Property Fund. Their dedication and commitment to excellence ensure that we continue to deliver high-quality investment opportunities for our clients.

Learn more about our Future Property Fund here.

Corinthian Balanced Fund

Unit Price

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

• The financial year starting unit price for the CBF was $1.00166 (ex-distribution price)

• The 31 October unit price is $1.013.

• The performance for the month of October is 0.04%.

• Financial YTD performance is 1.17%.

Portfolio Update

For the month of October, we continued our gradual buy in strategy with purchases of Australian shares to a value of approximately $516,500 plus we added a small parcel to TSCO at USD $28,865 We increased holdings in the following companies:

- ARB

- AX1

- CCP

- CSL

- DTL

- FPH

- NHF

- RMD

- SUL

- TNE

- TSCO

The main increases were for CSL, CCP and FPH as we took advantage of price weakness.

Conscious Investor Fund

In the realm of investments, finding exceptional opportunities can be like finding a needle in a haystack. But what if we told you there's a way to apply Warren Buffett's timeless principles to uncover top-tier companies?

Join us in a captivating video discussion on Ausbiz Australia with experts Mark Moreland and Howard Coleman. They unveil the magic of the Conscious Investor Fund software, which utilizes Buffett's ideals to filter through the market and pinpoint remarkable investment prospects.

Watch the video below and unlock the potential of smarter investments through the wisdom of Warren Buffett.

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, November 2023