In our September edition, we're thrilled to showcase an exciting investment opportunity within our corporate advisory division. This edition will continue to bring you in-depth updates and valuable insights into our investment funds' performance, as well as exclusive reports from our retail advisory division. Dive into recent developments, market trends, and expert analysis to empower your decision-making process.

TIP Group FY23 Results

After a COVID affected FY22, the financial year ended 30 June 2023 (FY23) saw substantial growth for Teaminvest Private Group Limited (TIP). Reporting highlights include:

- Look Through Revenue up 8% to $164.5m, a compound annual growth rate (CAGR) of 6% since FY17;

- Look Through EBITDA up 45% to $13.0m, a CAGR of 59% per annum since FY17;

- Operating Profit up 61% to $6.7m, a CAGR of 1,273% per annum since FY17;

Establishing our Wealth division; - Acquiring a 50% stake in Conscious Capital, the trustee and manager of the Conscious Investor Fund;

- Acquiring Enva, subject to final settlement, a retail financial advisory service with approximately $400m of funds under advice; and

- Declaring a fully-franked interim dividend of 0.275 cents per share, and a fully-franked final dividend of 0.300 cents per share, 5% higher than FY22.

Corporate Advisory

One of the primary focuses for our Corporate Advisory Team in the immediate term is to assist a Real Estate Fund with their equity capital raise for their upcoming acquisition—an exceptionally performing shopping centre asset in Queensland. Here are some key investment highlights:

8% Acquisition Capitalisation Rate: This is based on the current rental income, showcasing the attractiveness of this acquisition.

Annual Pre-Tax Distributions to Equity Investors (Forecast): Approximately 8.25% returns are projected for equity investors.

Levered IRR of 15%: This assumes a 55% Loan-to-Value Ratio (LVR) compared to the valuation, a six-year holding period, and cap rates returning to historical levels for the center (6.75%).

Experienced Management Team: The project benefits from a highly experienced management team known for their successful track record in acquiring, managing, and growing shopping centers.

Additionally, there's a notable financial advantage in this acquisition:

Immediate Value Creation: The acquisition represents a 23% discount to the center's 2019 valuation, offering an immediate value boost.

Untapped Potential: The potential for increased value, such as re-tenanting, has not been included in the initial assessment, leaving room for additional gains.

Low Gearing Opportunity: With a low gearing position, there's an opportunity to take on additional debt in the first 2-3 years, potentially benefiting investors early on.

Furthermore, the shopping center boasts exceptional operating fundamentals:

Strong Anchor Tenants: Major retailers like Woolworths, Coles, and K-Mart occupy 63% of the center's Gross Leasable Area (GLA).

High Occupancy: Occupancy rates are impressive at 99% by area and 98% by income.

WALE of 4.5 Years: The Weighted Average Lease Expiry (WALE) for the area is 4.5 years.

Prime Location: Situated in Queensland's second-fastest-growing city, the center benefits from a 7% annual growth rate driven by retirees and a robust local economy.

Modern Facilities: Redeveloped in 2005, the center features 1,066 parking bays, including 700 undercover spaces, with travelator access to supermarkets.

Retail Mix: The tenant mix is tailored to products and services typically consumed on-site.

High Replacement Value: The building's replacement value has been assessed at $170 million, making it unfeasible for competitors to replicate.

For those interested in exploring investment opportunities, please don't hesitate to contact our Corporate Advisory Team.

Retail Advisory

Is TPD worth it?

When we advise our clients about their insurance, TPD (Total and permanent disability) tends to be the cover that is seen as being the most unlikely one to claim on. The idea of being assessed as unlikely to ever return to work just seems so……..well, unlikely. However, our claims team has handled no less than 6 TPD claims over the last couple of years and we’re proud to say there has been a 100% success rate with all these claims being paid.

Nobody puts insurance cover in place believing they will ever need to claim, particularly for long term disability, so being able to assist these clients when they are needing support has been very satisfying. It has also reconfirmed, if there was a need to do so, just how important TPD is as part of a comprehensive risk management strategy. This is especially true with the changes introduced to income protection a couple of years ago that have diluted somewhat the cover it provides for longer term claims. When it is paired with income protection, it ensures you have cover in place not just to provide income to cover day to day costs but also cover to provide for the long term right through to retirement and beyond.

If you don’t have any TPD cover in place at the moment or are unsure what you have, please contact the Enva team and we would be happy to help. Remember that not all policies are the same so if you have some TPD cover through a super fund we can show you how it compares to full retail policies and the features and benefits you may be missing out on. Not only that, these group policies are sometimes more expensive and who wants to pay more for less!

Mortgage Broking

RBA holds cash rate at 4.10%

For the third consecutive month, The Reserve Bank of Australia (RBA) has decided to hold the official cash rate at 4.10%.

The decision to maintain the cash rate at 4.10% comes after the monthly Consumer Price Index (CPI) fell to 4.9% in July, down from a peak of 8.4% in December last year.

Economic Update

Market Update and Economic Outlook – September 2023

Stock Market Update

United States

US stocks, led by Nasdaq, fell as Apple's product launch failed to boost equities. Weak tech forecasts, notably from Oracle, dragged down the S&P 500 (-0.6%) and Nasdaq (-1%). The Dow Jones slipped 0.1%. Investors watch inflation data before the Fed meeting next week. Rate hike uncertainty persists.

Market analyzes signals for a pending recession. Materials and industrials slipped; utilities rose. Bond market saw the 10-year Treasury yield drop to 4.263%. Tech sector, led by Oracle's 13% fall, impacted markets. Microsoft, Adobe, Broadcom, and Nvidia declined. Apple shares fell 1.7%.

Automaker stocks rose as union demands softened. Ford (+1.9%), General Motors (+2.6%), and Stellantis (+2.6%) gained. WestRock (+2.8%) to be acquired by Smurfit Kappa for $11.15 billion.

Australia

Australian shares are expected to drop due to a tech stock decline on Wall Street. US stocks fell, led by the Nasdaq Composite, despite Apple's product launch. Weak tech forecasts, particularly from Oracle, weighed on the S&P 500 (-0.6%) and Nasdaq (-1%). Investors are watching for Wednesday's consumer-price index release ahead of the Federal Reserve meeting. There's uncertainty about future interest rate hikes.

In commodities, Brent crude rose to $92.06, gold held at $1,913.48. Australian 2-Year bond yields inched up to 3.86%, and the 10-Year held at 4.16%. In the US, 2-Year Treasury yields rose to 5.02%, and 10-Year yields dipped slightly to 4.28%.

The Australian dollar remained at 64.23 US cents, while the Wall Street Journal Dollar Index edged up to 98.94.

Inflation:

A glance at key data shows unemployment rising from 3.5% to 3.7% in July. The Australian Bureau of Statistics cautioned against reading too much into that. The last time unemployment rose was in April, which happened to coincide with school holidays.

The bureau also “continued to see some changes around when people take their leave and start or leave a job. It’s important to consider this when looking at month-to-month changes.”

Meanwhile annual inflation fell from 5.4% to 4.9% -- weaker than the expected 5.2%.

Taking a deeper dive on the numbers and excluding volatile items (fruit and vegetables,

automotive fuel, and holiday travel and accommodation) annual inflation rose 5.8%, down

from 6.1%

September 2023 Highlights

The anticipated stabilization in China's housing market has not materialized as expected, and there is a potential drop of up to 20% in new sales for this year. Housing constitutes a significant third of total investments and contributes 12% to China's GDP, exerting substantial multiplier effects on the broader economy. Despite some policy easing efforts, the impact has been less than desired, and there's a decline in export demand as well.

In contrast, rapid growth in U.S. consumer spending has persisted throughout the year, even with the Federal Reserve's tightening measures. This growth has been supported by a USD1.2 trillion reduction in pandemic savings and robust growth in nominal household incomes, driven by rising employment and wages. However, recent months have seen a slowdown in labor demand, and wage inflation is expected to moderate as the labor market cools.

Additionally, there's a growing tightening of credit conditions in the U.S., with the credit impulse now turning negative. Furthermore, a decrease in profit growth signals potential challenges for business investment prospects. While we still anticipate a mild U.S. recession, our revised outlook places it in the first half of 2024.

Stock Highlight

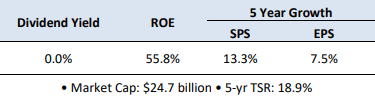

Ulta Beauty Inc (ASX: ULTA)

The US beauty products and salon services market is highly fragmented with over 70,000 places to buy beauty products. It is also huge with 2021 sales estimated at US$140 billion.

Ulta Beauty stepped into this market in 1990 with a single store. The company is now the largest beauty retailer in the US with a network of over 1300 stores across the US, which provide, as it says, “All Things Beauty, All in One Place”. The stores aim to be premier beauty destinations for cosmetics, fragrances, skin and hair care products and salon services (hair, skin and brow).

It offers more than 25,000 products from over 600 well-established and emerging beauty brands across all categories and price points, including Ulta Beauty's own private label. A recent partnership with Target U.S. has opened co-located outlets.

It also has an online division through its website, which includes tips, tutorials and social content.

Despite this growth, the company estimates that it has just 4% of the national market. Plenty of room for continuing expansion.

Success Drivers: Ulta Beauty targets what they call “beauty enthusiasts”, people (generally women) who have a “high passion for beauty”.

The company refers to its customers as guests. This is part of their differentiation strategy by making their customers feel special. They try to provide a distinctive and personalised experience and have bright, open stores with non-commissioned sales teams.

Customers are encouraged to become members of the company’s loyalty program called Ultamate. Currently this program has over 37 million members. Ulta uses sophisticated mining of the database resulting in greater personalization and precision of its marketing campaigns, including special deals from manufacturers. Confidential: Do not photocopy or distribute without permission © Conscious Capital August 2023 Page 8 Company Statement: “We know our guests love the thrill of discovery, the rituals of self-care and the fun of self-expression. Our community represents all ages, genders, skin tones and abilities.”

Economic Moats: Its primary moat is that all the stores have salon services: salon clients spend 3 times more and visit 2 times more than those who don’t use these services. This makes their stores “onestop” shops for beauty products and salon services resulting in more “sticky” customers. A second moat is its loyalty program with its associated data on their buying habits: over 37 million members contribute 90% of sales. Finally, convenient, high-traffic locations help customer traffic.

Main Future Risks: The company loses its edge in providing beauty products and services wanted by their current and potential customers. Also online sales (Amazon, etc) eat away at their margins.

Conclusion: Many surveys conclude that women use makeup, skin care products and salon services to help feel good about themselves. This helps explain the size of the market and why it is likely to keep growing at a solid pace. Ulta Beauty is a savvy operator in this area with proven ability to attract and maintain customers with plenty of room to continue its high earnings growth.

Shareholder updates

Icon Metal

Congratulations to our partners at Icon Metal! We're proud to celebrate their outstanding work on the Circular Quay Tower project.

Their contributions, including the installation of the structural steel supporting the Southern Hemisphere's largest internal LED wall, are truly remarkable.

Circular Quay Tower

Teaminvest Access Fund

You have probably noticed that the Teaminvest Access Fund Newsletter now contains additional information including information about TIP Group, market and industry updates as well as investment opportunities. We hope that you find the additional content insightful, useful, and informative.

Unit Pricing

The unit prices for August 2023:

15th August 2023 $0.8943

31st August 2023 $0.9013

Fund Information

We are happy to advise that the Fund has outperformed the ASX200 Accumulation Index by 3.11% for the month of August 2023.

Investor Portal

You can access your investor portal at any time using the following link: https://investors.tipgroup.com.au/py/sys.pyc Should you have any problems accessing your Investor Portal please email funds@tipgroup.com.au or call us on 1300 160 803 and our Funds Administration Team will happily assist.

Statements

All Teaminvest Access Fund Members can expect to receive the following statements via their investor portal:

· Quarterly Statements will be issued after each quarter end.

· Annual Statement will be issued after end of financial year.

· Distribution Statements when we declare a distribution.

· Annual Tax Statement will be issued by September.

We are expecting to issue the 2022/2023 End of Financial Year Tax Statements in September.

Should you have any questions regarding your statement please contact our Funds Administration Team.

Contact Us

Our Funds Administration Team are here to assist you if you have any questions regarding your current investment or would like to make a new or additional investment. Please do not hesitate to contact us via phone or email. You can reach us on 1300 160 803 or funds@tipgroup.com.au

*Past performance is not indicative of future performance

Private Equity Fund

The TIP Wealth Private Equity Fund paid its inaugural distribution for 30 June 2023 to investors of 9.35 cents per unit which is a distribution yield of 6.85%.

*Past performance is not indicative of future performance

Future Property Fund

Building a Sustainable Future: The Power of the Living Building Challenge

In our ever-evolving world, sustainability has become a crucial consideration in all aspects of our lives. This is especially important in the realm of housing and property development. As an investment fund committed to creating a sustainable future, we firmly believe in the transformative power of the Living Building Challenge.

The Need for Housing Sustainability:

As our population continues to grow and resources become increasingly scarce, the importance of sustainable housing cannot be overstated. Housing sustainability involves designing and constructing buildings that minimize their environmental impact, promote human health and well-being, and contribute positively to the surrounding community. By adopting sustainable practices, we can create homes that are not only resilient and energy-efficient but also enhance our quality of life and protect our planet for future generations.

Coliving:

In the pursuit of sustainable housing, innovative solutions are emerging to address the challenges of urban living and community well-being. Coliving is a housing concept that emphasizes communal living, collaboration, and a sense of belonging. It involves shared spaces and resources, such as kitchens, common areas, and amenities, while providing private living spaces for individual residents. By creating a supportive environment that encourages social interaction, coliving addresses the challenges of urban isolation, promotes resource efficiency, and fosters a sense of community.

Coliving and the Living Building Challenge share common goals of sustainability, community well-being, and resource optimization. The Living Building Challenge's Petals—Place, Water, Energy, Health + Happiness, Materials, Equity, and Beauty—provide a framework for coliving developers to create sustainable and vibrant communities.

Our Part to Play:

As an investment fund, we recognize the immense potential of sustainable property development. By aligning our investment strategy with the Living Building Challenge, we foster a portfolio of properties that not only provide financial returns but also contribute to a more sustainable future. Investing in projects that meet the Living Building Challenge guidelines ensures that we support the creation of buildings with minimal environmental impact, improved energy efficiency, and a focus on occupant well-being.

Developing properties within the framework of the Living Building Challenge brings numerous benefits to both investors and communities. Firstly, these projects reduce operational costs through efficient energy and water use, creating long-term financial viability. Secondly, they prioritize the health and happiness of occupants, resulting in increased productivity and well-being. Moreover, Living Building Challenge projects often foster a sense of community and equity, promoting social cohesion and inclusivity.

We are proud to champion the principles of the Living Building Challenge. By actively seeking out developers who embrace this framework, we ensure that our investments contribute to a sustainably built environment. We believe that our commitment to housing sustainability not only mitigates environmental risks but also positions us at the forefront of a growing market demand for responsible and regenerative properties.

As an investment fund, our commitment to the Living Building Challenge reflects our dedication to investing in projects that have a positive impact on both the environment and society. Together, we can build a future where sustainable housing is the norm, creating a world we can proudly pass on to future generations.

Learn more: Future Property Fund

Corinthian Balanced Fund

Unit Pricing

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

- The financial year starting unit price for the CBF was $1.00166 (ex-distribution price)

- The 31 August unit price is $1.0123

- The performance for the month of August is 0.48%

- Financial YTD performance is 1.06% for the first two months

Total units on issue remain unchanged at 60,711,765.

Notes:

- Additional interest of $49,257.26 was received on 1 September for funds held in savings at-call.

- Term deposit accrued interest of $259,216.44 as at 31 August is not included in the August unit price calculation as interest is payable at maturity (on 12/9/2023 and 11/12/2023 respectively).

- Dividends of ~$40k accrued in the FY23 reporting season are yet to be received.

*Past performance is not indicative of future performance

Conscious Investor Fund

Howard Coleman and Mark Moreland, co-founders of Teaminvest Private and Conscious Capital, recently appeared on AusBiz to discuss their investment strategy. They explained our key terms, "Wealth Winners" and "Capital Killers," which are integral to our approach and helping us to assess investments.

Numerous factors within the analysis framework contribute to categorising potential investments. The video below provides a basic overview of "Wealth Winners" and "Capital Killers" and their determination process, highlighting the significance of thorough analaysis and due diligence in shaping an investment portfolio.

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, September 2023