Welcome to August's edition of our newsletter. This month, we are excited to announce the release of the TIP Group 2024 Annual Report. Additionally, our investment manager Craig Wright has been honored with the CEO of the Year Award for his outstanding leadership in the property fund sector. Don't miss our latest updates on the TeamInvest Access Fund and the Corinthian Balanced Fund, as well as a comprehensive economic update. Dive in for all these highlights and more from our divisions.

TIP Group News

TIP Groups 2024 annual report is now available.

Strong operating cashflow enables investment for growth

FY24 was a great year for TIP. We invested over 20% of our market cap in growth initiatives, returned a further 3% to shareholders via dividends and buybacks, and ended the year with net cash and listed investments of $9.5m.

Look-Through EBITDA, our preferred operating metric, rose 21% to $15.8m, and we declared a final fully-franked dividend of 1.5c per share.

Read the full report here

Corporate Advisory

We're excited to share that our investment manager, Craig Wright, has been named APAC Insider's CEO of the Year for 2024 - his second consecutive win!

Retail Advisory

Breaking Free from the Work-Life Hamster Wheel in Your 40s and 50s

A Shift in Perspective

The post-pandemic era has ushered in profound changes, particularly for those of us in our 40s and 50s.

We're increasingly aware that life is fleeting. Our kids are getting older.

Our parents' version of success, living to work and tirelessly paying off a house, no longer appeals to us.

It's time to step off the work-life hamster wheel and start working smarter, not harder.

A Wake-Up Call

At 40, I'm reminded that the average Australian retires at 56, not at 65 or 67 as many believe.

This realization is a wake-up call. We have less time than we think to plan for a future where we're not just surviving but thriving.

Debt Recycling: A Path to Financial Liberation

Debt recycling is a strategy long used by the financially savvy, and it's high time more of us tapped into it. It's not just about making money work harder; it's about using the tax system to our advantage, much like the rich do. This approach is accessible and can be a game-changer for those willing to learn and apply its principles.

The Tree Analogy Revisited

Imagine your mortgage as a large, dormant tree in your backyard. It's stable and secure, but it's not contributing much else. Now, imagine transforming parts of this tree into fruit-bearing branches. This is what debt recycling does to your mortgage – turning a static, non-productive entity into an active, wealth-generating asset.

Case Study: Emily and David

Emily and David, a couple in their late 40s, chose to use their home equity to invest. This investment generated income and tax benefits. Instead of splurging, they used this income to reduce their mortgage. Over time, they not only decreased their mortgage but also built a substantial investment portfolio. By their mid-50s, they had achieved a balance that allowed them to step off the traditional work-life hamster wheel.

Why This Matters

• Efficient Wealth Growth: Emily and David transformed their mortgage into a wealth-building tool.

• Escape the Work-Life Cycle: They moved away from the traditional path of working full-time just to pay off a house.

A Balanced Approach

While debt recycling can be transformative, it's not without risks and requires a balanced, informed approach. It's crucial to get professional advice to understand if this strategy aligns with your financial situation and goals.

Is This Your Path to Financial Freedom?

If you're seeking to escape the traditional work-life cycle and make your financial resources work more effectively for you, debt recycling might be the strategy you need.

Contact our Retail Advisory Team: Retail Advisory

Economic Update

Equity Markets

- The ASX 200 rose 0.85% in June following a rise of 0.49% in May. For financial year the ASX 200 rose 7.83%

- The S&P500 rose 3.47% in June following a rise of 4.8% in May. For the financial year the S&P500 rose 22.69%. A significant portion of this rise can be attributed to a select number of stocks including NVDA, AAPL, MSFT, GOOGLE & AVGO.

Inflation

The figures released by the Australian Bureau of Statistics show that the monthly Consumer Proce Index (CPI) indicator rose 4.0% in the 12 months to May 2024, up from 3.6% in April.

The most significant contributors to the annual rise to May were Housing (+5.2 per cent), Food and non-alcoholic beverages (+3.3 per cent), Transport (+4.9 per cent), and Alcohol and tobacco (+6.7 per cent).

The June inflation and QoQ number will be pivotal to the RBA decision on rates at their August meeting. If the Q2 rate is 1% or more, we might see another insurance rate rise.

Interest Rates Australia

There is a lot of discussion around interest rates with economists and others split as to whether the RBA will increase or cut rates in the near term.

In the recent RBA minutes, the central bank pondered whether a rate hike was needed due to “upside risks of inflation” but decided to hold rates steady.

As mentioned above, the Q2 inflation rate will affect the August interest rate decision. Together with recent retail sales growth and stubborn inflation this combination further strengthens the case for a hike this year and possibly in August.

Economy

There are many moving parts to the economy, and they change regularly.

Some slightly better news in Australia with retail sales came in higher than expected for May, growing 0.6% against a forecast of a 0.3% increase, after a rise of 0.1% in April. The YoY figure came in at 1.7%.

There was also a lift in building approvals for May – refer ABS release 3 July. Information can be found via the following link.

Building Approvals, Australia | Australian Bureau of Statistics (abs.gov.au)

Trade balance down.

The big question is how frustrated is the RBA with how slow inflation is falling?

US

- Low-income consumers are feeling the brunt of higher inflation.

- Middle income earners are now starting to pull back on discretionary spending.

- There is an expectation that the Fed will cut rates over 2024 and 2025.

- Lower mortgage rates will be needed to turnaround the housing downturn.

- Median mortgage payment as a share of household income has risen from 19% in 2019 to 28% as of 2024.

- Wages growth at 4.4% year on year over Q1 2024.

- Employment up 1.8% year on year over Q1 2024.

- US unemployment rose from 4% to 4.1% in June and there is an expectation from some analysts that this could go higher next year.

Stock Highlights

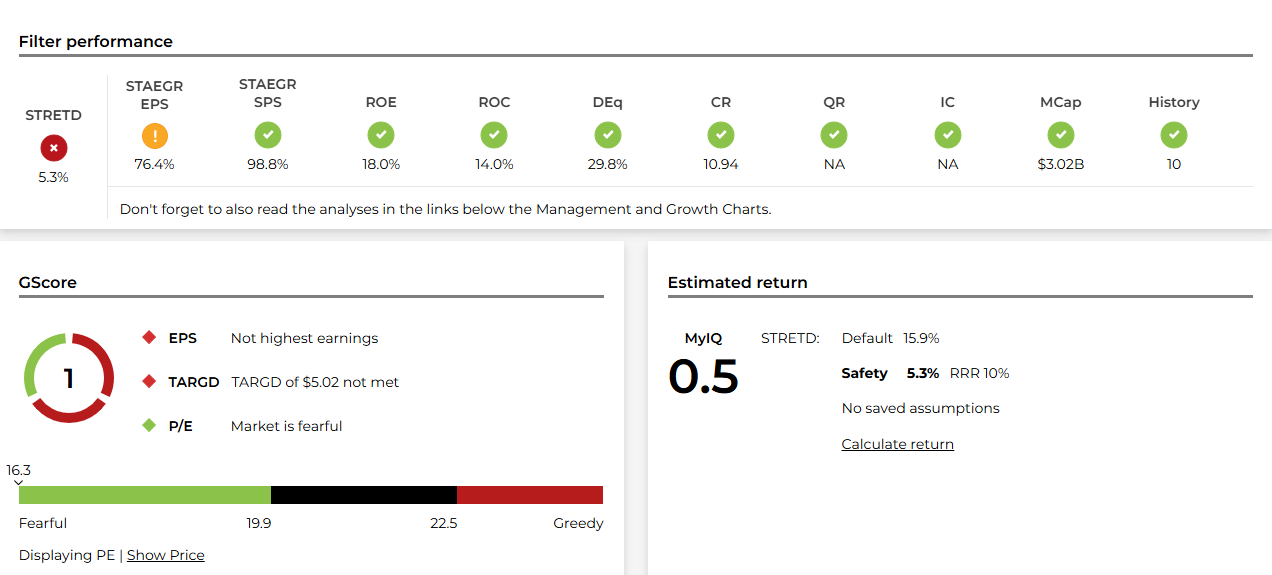

Nib Holdings (ASX:NHF)

nib Holdings Limited is a private health insurer and health care management company based in Australia and New Zealand. It underwrites and distributes private health insurance to Australian and New Zealand residents, as well as international students and visitors to Australia. In addition to health insurance, the company also sells and distributes travel insurance policies globally and underwrites and distributes life and living insurance in New Zealand. Another part of nib's business is its joint venture with Cigna Corporation, Honeysuckle Health, which provides specialist health care data science services.

In recent years, nib has expanded its operations to include the management of National Disability Insurance Scheme (NDIS) plans, following the acquisition of several NDIS plan managers. This has led to the launch of nib Thrive, the brand name for nib's NDIS business. nib also made a significant acquisition in 2023, purchasing 100% of the issued capital in Kynd Group Pty Ltd, a digital marketplace for people who use Australia’s National Disability Insurance Scheme (NDIS).

Conscious Investor data as at July 2024:

NFP Practice

TIP Group is proud to be a Platinum sponsor for this year's Third Sector Au Live event in Royal Park, Darling Harbour from the 10-12th of September.

For the past two years, TIP Group has hosted monthly Round Table events tailored to the NFP sector. These gatherings have facilitated valuable knowledge-sharing among board members and executives from across Sydney, advancing our mission in education.

Education forms the foundation of TIP's philosophy, enabling our stakeholders to maximise their impact for their organisation. By supporting such a prestigious conference with 200+ NFP leaders from all over Australia, we look forward to sharing knowledge and facilitating new relationships.

Learn more about Third Sector Live here

Book your spot for the event here or

Learn more about TIP Groups NFP Practice and the services we offer here.

Shareholder updates

Icon Metal

We’re pleased to highlight a remarkable achievement by our portfolio company, Icon Metal. Recently, Icon Metals skilled team completed the installation of a 16.980-meter-long bridge, weighing 26.99 tons, at the Prince of Wales Hospital. This bridge now seamlessly connects to the Sydney Children's Hospital, offering a vital link between the two facilities.

The project was not without its hurdles. They faced limited access for cranes and support vehicles, a strict timeline for fabrication and installation, challenging weather conditions including heavy winds, and a site surrounded by active buildings with healthcare staff and patients. To tackle these challenges, the bridge was delivered in three sections, featuring a pre-fabricated beam. By connecting the frames off-site, they were able to speed up the installation process and minimise potential disruptions.

See some pictures from the installation on their LinkedIn Page Here

Teaminvest Access Fund

Unit Pricing

The Quarterly Unit prices for March to July 2024:

|

15th April 2024 |

$0.9414 |

|

30th April 2024 |

$0.9385 |

|

15th May 2024 |

$0.9374 |

|

31st May 2024 |

$0.9377 |

|

15th June 2024 |

$0.9485 |

|

30th June 2024 |

$0.9548 |

|

15th July 2024 |

$0.9391 |

Access Fund Performance – 2023/2024 Financial Year

The investment objective of the fund is to provide superior returns to the S&P/ASX 200 which returned 7.83% for the financial year.

The fund outperformed the S&P/ASX 200 by 1.6% returning 9.43% for the year. This outperformance was achieved with less volatility due to holding commercial debt within the fund.

2024 Q2

During the second quarter of 2024, the Australian investment landscape exhibited a mixed picture, influenced by both domestic and global factors.

The Australian share market represented by the S&P/ASX 200 was down 1.01%. Energy and material were the main drag on the market.

On 31 July the ABS released consumer price index (CPI) data. The CPI rose 1% in the June quarter and 3.8% annually. This annual rise is up from 3.6% at the end of the March quarter.

The RBA looks closely at the “trimmed mean inflation rate” and the annual trimmed mean inflation rate was 3.9%, down from 4% in the March quarter. The broader trend of decreasing trimmed mean inflation, signals a slowing in underlying price pressures.

Once again reporting season is here, and we are celebrating the continued successful performance of our investments in their earnings growth. What is more cause to celebrate is the wider market doesn't see what we do and is giving us fantastic opportunities to pick up more investments at great prices. Yes, as expected, this will have a short-term impact on our next few unit price releases but as confident investors we look forward to these opportunities to make money riding out the wider market hysteria.

Distribution

A distribution for the second half of FY23-24 was paid on 07 August 2024. Investors received a Distribution statement detailing this distribution via email and is available in the Investor Portal.

Statements

All TeamInvest Access Fund Members can expect to receive the following statements via their investor portal and email:

- The Quarterly Statement for April to June, which was delayed, was issued on 26 July 2024

- Annual Statements will be issued in August 2024

- Distribution Statements will be issued in August 2024

- Annual Tax Statement will be issued in September 2024

If you have any questions regarding your statement, please contact our Funds Administration Team.

Investor Portal

You can access your investor portal at any time using the following link: https://investors.tipgroup.com.au/py/sys.pyc

Should you have any problems accessing your Investor Portal please email funds@tipgroup.com.au or call us on 1300 160 803 and our Funds Administration Team will happily assist.

Contact Us

Our Funds Administration Team are here to assist you if you have any questions regarding your current investment or would like to make a new or additional investment.

Please do not hesitate to contact us via phone or email. You can reach us on 1300 160 803 or funds@tipgroup.com.au

*Past performance is not indicative of future performance

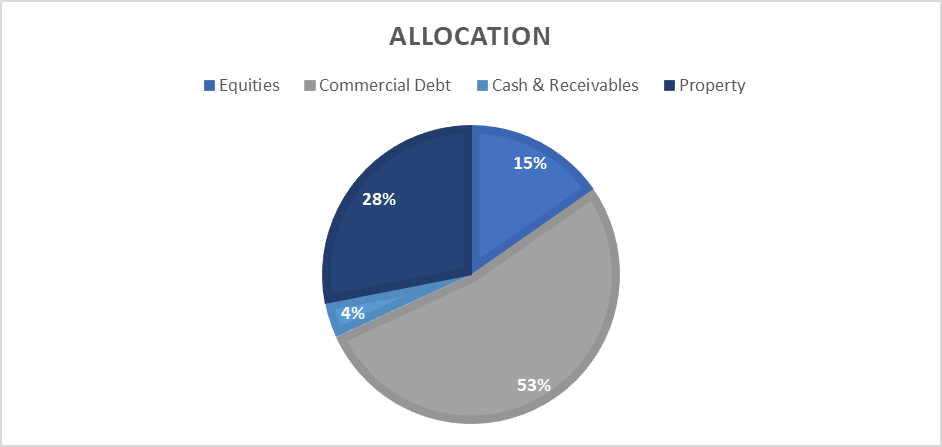

Corinthian Balanced Fund

Unit Pricing:

As of 31 July 2024, the unit price of the CBF was $1.0916, with a performance of 1.74% for the month (after all fees).

- The CBF has a total portfolio value of $67,403,880 with growth assets accounting for 41.91% and defensive assets accounting for 58.09%.

- Commercial debt investment increased circa $2.9mil.

- Stock markets rose in July with the ASX200 rising (4.18%) and the S&P500 rising (1.09%).

Once again reporting season is here, and we are celebrating the continued successful performance of our investments in their earnings growth. What is more cause to celebrate is the wider market doesn't see what we do and is giving us fantastic opportunities to pick up more investments at great prices. Yes, as expected, this will have a short-term impact on our next few unit price releases but as confident investors we look forward to these opportunities to make money riding out the wider market hysteria.

Property Fund

We're excited to announce that our Future Property Fund has been rebranded as the Property Fund, reflecting its expanded focus on strategic property investments. Our updated Property Fund now includes:

- Equity and Debt Investments: Targeting opportunistic land and property development projects, encompassing both residential and commercial assets.

- Strategic Real Estate Acquisitions: Focusing on acquiring real estate at a discount to valuation, with clear pathways to sustainable income and potential for above-benchmark capital growth.

- Debt Facilities: Offering financing through preferred 1st or 2nd mortgage positions.

- Diverse High-Yield Property Assets: Incorporating innovative investment opportunities such as co-living properties, underdeveloped land in high-growth areas, and social and affordable housing initiatives.

The Property Fund is designed to deliver robust returns while supporting sustainable and impactful developments. We're committed to seizing growth opportunities in the property sector and are excited to continue delivering value to our investors.

Read our new Information Memorandum for more information

Property Fund Information memorandum

Property Fund

We're excited to announce that our Future Property Fund has been rebranded as the Property Fund, reflecting its expanded focus on strategic property investments. Our updated Property Fund now includes:

- Equity and Debt Investments: Targeting opportunistic land and property development projects, encompassing both residential and commercial assets.

- Strategic Real Estate Acquisitions: Focusing on acquiring real estate at a discount to valuation, with clear pathways to sustainable income and potential for above-benchmark capital growth.

- Debt Facilities: Offering financing through preferred 1st or 2nd mortgage positions.

- Diverse High-Yield Property Assets: Incorporating innovative investment opportunities such as co-living properties, underdeveloped land in high-growth areas, and social and affordable housing initiatives.

The Property Fund is designed to deliver robust returns while supporting sustainable and impactful developments. We're committed to seizing growth opportunities in the property sector and are excited to continue delivering value to our investors.

Read our new Information Memorandum for more information

Property Fund Information memorandum

Private Equity Fund

Unlocking Australia’s $50 Billion Economic Boost: The Private Equity-Led Manufacturing Renewal

In the post-COVID-19 landscape, Australia’s manufacturing sector stands on the brink of a pivotal resurgence. Traditionally viewed as just another economic component, manufacturing has emerged as the backbone of innovation and self-sufficiency—especially as the pandemic underscored the critical nature of domestic production capabilities. With Australia ranking last in manufacturing self-sufficiency among OECD countries, the call for a strategic overhaul is loud and clear. This is where private equity steps in, poised to play a transformative role.

Private equity offers the financial muscle and strategic acumen necessary to rejuvenate Australia’s manufacturing base. By infusing capital and expertise into this sector, private equity promises not only to revitalise operations and facilitate technological advancements but also to steer firms towards high-value production and global competitiveness. The potential economic boost is staggering, with a forecasted $50 billion uplift that spells jobs, innovation, and resilience.

The manufacturing sector isn’t merely another industry; it’s a rich tapestry of opportunities for high-quality, full-time employment and a linchpin of global trade. As Australia navigates its post-pandemic recovery, private equity stands ready to fuel this manufacturing revival, championing a future of economic strength and innovation.

This investment isn’t just about profit—it’s a strategic move towards securing Australia’s economic future, making the private equity-led manufacturing renewal a cornerstone of Australia’s roadmap to recovery and prosperity.

Learn more about our Private Equity Fund

*Past performance is not indicative of future performance

Future Property Fund

196-206 High Street Windsor

The TIP Team headed over to High Street Windsor this month to watch some of the building process. Along with Melbourne based Property Developers, the Chapter Group as well as Real Estate and technology and innovation company, Taronga Group, we are excited to see this impressive building unfold.

Get involved here: Contact our Corporate Advisory Team

Corinthian Balanced Fund

February 2024 Update

- The CBF growth assets account for approximately 43% of the total portfolio and defensive assets of approximately 56.42%

- For March there were no investments into equities and circa $1.1mil increase into commercial debt opportunities

- Stock markets rose again with the ASX200 rising 1.95% and the S&P500 rising 3.1%.

Unit Price

- The financial year starting unit price for the CBF was $1.00166 (ex-distribution price).

- As of 31 March 2024, the unit price of the CBF was $1.0755

- The performance for the month of March after all fees was 0.42%

- Financial YTD performance is 7.37% (for 9 months to 31 March 2024)

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

*Past performance is not indicative of future performance

Conscious Investor Fund

Welcome to the interim Letter for members of the Conscious Investor Fund, families and friends:

Over the past 12 months the performance of the Fund was 16.29%. Since inception, the investments of our early Members have tripled in value since they were first deposited. (You can see this in the growth chart in the Report.)

The Letter also takes a deep dive into Alphabet (Google) one of our largest holdings: what drives it with the sort of success that makes it likely we will want it to be a key holding for many years to come. Since 2015 the Fund has purchased 22 parcels of Alphabet shares for a current holding of 52,000 shares for a total value of AUD$11.6 million. This means an average annual return of 23.18% since the first purchase.

We also look at some of the penetrating remarks and quips by Charlie Munger, Warren Buffett’s late friend and partner, who passed away in December last year at age 99 years.

We wish health and wealth for you and your family for 2024. Let us know if you have any questions.

From John Price and Members of the Capital Allocation Team.

Dr John Price

Conscious Investor Fund

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, August 2024