Dive into March's TIP Group newsletter for the latest insights! Highlights include the impactful Strategy Day in Sydney and an enlightening interview on the rebirth of VOLT Tech with We Are Embedded. Stay updated with our diverse divisions, curated funds, shareholder companies, and a comprehensive economic update in this month's edition.

TIP Group News

TIP Group Strategy Day

During our transformative annual strategy day last week in Sydney, TIP Group united board members, select shareholders, and key staff to forge the path ahead.

A standout moment was John Abernathy, Chairman of Clime, who delivered an enlightening economic update, enriching our strategic perspectives. Equally compelling were insights from esteemed UNSW researchers, who delved into decision-making processes and leadership dynamics. This gathering wasn't just about charting the future of TIP Group; it was a celebration of shared wisdom and visionary leadership.

Here are some snapshots of some of these pivotal presentations as well as some moments of collaboration and forward thinking within group discussions, capturing the essence of our journey towards excellence.

Corporate Advisory

We are Embedded / VOLT

Michael Baragwanath and TIP Group play a pivotal role in the rebirth of Volt Bank's technologies through Luke Bunbury's latest venture, We Are Embedded. After Volt Bank's unexpected closure due to financial challenges, Embedded has surfaced as the new custodian of Volt’s assets, especially its 'banking as a service' tech stack and the Australian Mortgage IP. Michael Baragwanath, head of wealth and investment banking at TIP Group, has assumed the position of chair at Embedded, signaling a strategic move by TIP to leverage its advisory prowess in this innovative transformation.

TIP Group, renowned for its investments in Australian privately-owned businesses and its advisory services, has endorsed Embedded by taking a one percent stake with options for enhancement. This involvement underscores TIP's commitment to nurturing financial technology advancements that promise to streamline banking services for smaller institutions and financial planners. With a visionary outlook, Baragwanath has articulated a market gap for premium, technology-driven banking solutions that combine high-end technology with personalised customer service. Embedded aims to fill this void, optimising the mortgage process to realise assessments within dramatically reduced timeframes.

Embarked on this venture, Baragwanath and TIP exhibit a strategic anticipation of substantial returns through disciplined value investing. By offering Volt’s shareholders an opportunity to convert their investments into shares of Embedded, the initiative not only seeks to rejuvenate Volt’s innovative spirit but also to knit a path for shareholders to potentially recover and even enhance their investments. With a calculated vision and strategic leveraging of Volt’s technical assets, Baragwanath, TIP, and Embedded are navigating towards pioneering a high-value, technology-embedded banking experience, aiming for a valuation exceeding $140 million that promises a new era in financial services.

Retail Advisory

Breaking Free from the Work-Life Hamster Wheel in Your 40s and 50s

A Shift in Perspective

The post-pandemic era has ushered in profound changes, particularly for those of us in our 40s and 50s.

We're increasingly aware that life is fleeting. Our kids are getting older.

Our parents' version of success, living to work and tirelessly paying off a house, no longer appeals to us.

It's time to step off the work-life hamster wheel and start working smarter, not harder.

A Wake-Up Call

At 40, I'm reminded that the average Australian retires at 56, not at 65 or 67 as many believe.

This realization is a wake-up call. We have less time than we think to plan for a future where we're not just surviving but thriving.

Debt Recycling: A Path to Financial Liberation

Debt recycling is a strategy long used by the financially savvy, and it's high time more of us tapped into it. It's not just about making money work harder; it's about using the tax system to our advantage, much like the rich do. This approach is accessible and can be a game-changer for those willing to learn and apply its principles.

The Tree Analogy Revisited

Imagine your mortgage as a large, dormant tree in your backyard. It's stable and secure, but it's not contributing much else. Now, imagine transforming parts of this tree into fruit-bearing branches. This is what debt recycling does to your mortgage – turning a static, non-productive entity into an active, wealth-generating asset.

Case Study: Emily and David

Emily and David, a couple in their late 40s, chose to use their home equity to invest. This investment generated income and tax benefits. Instead of splurging, they used this income to reduce their mortgage. Over time, they not only decreased their mortgage but also built a substantial investment portfolio. By their mid-50s, they had achieved a balance that allowed them to step off the traditional work-life hamster wheel.

Why This Matters

• Efficient Wealth Growth: Emily and David transformed their mortgage into a wealth-building tool.

• Escape the Work-Life Cycle: They moved away from the traditional path of working full-time just to pay off a house.

A Balanced Approach

While debt recycling can be transformative, it's not without risks and requires a balanced, informed approach. It's crucial to get professional advice to understand if this strategy aligns with your financial situation and goals.

Is This Your Path to Financial Freedom?

If you're seeking to escape the traditional work-life cycle and make your financial resources work more effectively for you, debt recycling might be the strategy you need.

Contact our Retail Advisory Team: Retail Advisory

Mortgage Broking

The Reserve Bank of Australia (RBA) has decided to again hold the official cash rate at 4.35%.

The decision to maintain the cash rate follows relatively stable inflation rates over the last quarter.

Get in touch with our Mortgage Broking team today: Mortgage Broking

Economic Update

Market Update and Economic Outlook – February 2024

Wages

Following a period of low wages growth, we saw the Wage Price Index advancing 4.2% YoY in Q4 2023 just above forecasts. It’s the first-time annual wage growth has outpaced inflation since March 2021, and is the highest jump in annual wages in almost 14 years.

Equity Markets

ASX S&P200 edged up 0.8% and closed the month at a new record high.

The S&P500 logged its fourth consecutive monthly gain, up 5.17%, on the back of blowout earnings from chip maker and AI leader Nvida.

February Reporting Season

The season saw more broker downgrades than upgrades and together with market expectations not being met in some instances, we saw some stocks being marketed down heavily. This provided us with a few buying opportunities.

Inflation

Late in February the inflation numbers were released with an annual rate of 3.4% to 31 January 2024. This was below forecast expectations of 3.6%.

Excluding volatile items from the CPI, such as fuel and holiday travel, the ABS said the annual rise in January was 4.1 per cent, down from 4.2 per cent in December.

“Annual inflation when excluding volatile items has been declining since the peak of 7.2 per cent in December 2022,” said Michelle Marquardt, ABS head of prices statistics.

Among the biggest contributors to the January annual increase was insurance and financial services (+8.2 per cent), while partially offsetting the rise was holiday travel and accommodation (-7.1 per cent). Housing’s rise of 4.6 per cent in the 12 months to January was down from 5.2 per cent in December, driven by new dwelling prices rising 4.8 per cent over the year with builders passing through higher costs for labour and materials.

Interest Rates

In February the RBA meeting minutes showed that the RBA debated hiking rates at February’s meeting. This indicates they are in no hurry to cut rates until inflation in clearly trending down.

In the US, minutes of January’s FOMC meeting signaled concerns over potentially cutting rates too soon.

There is likely to be a lot of discussion around the timing of interest rate cuts with market participants taking positions based on their reasoning around rate cuts.

Therefore, “Are markets too confident about rate cuts this year”? Markets are building up expectations in the US, UK and Europe for significant rate cuts. Is Australia on the same trajectory?

Irrespective of the outcome we have market participants that will act on their beliefs on the direction and timing of interest rate cuts. This may create extra volatility in the market and provide us with buying opportunities.

GDP

Australia’s economy grew just 0.2% over the Dec quarter, which was lower than the increase on population meaning that economic activity per person fell. For the 2023 calendar year the economy grew 1.5% but when looking on a per person basis, the economy shrank by 1% over 2023. The 1.5% is the smallest increase in a quarter-century, excluding the pandemic years. This compares to more normal levels of GDP growth should be closer to 2.75%-3%.

ABS information released early March showed that households increased their spending on essentials like electricity, rent, food and health. Meanwhile, consumers would back spending in discretionary areas such as hotels, cafes & restaurants, new vehicle purchases and clothing and footwear.

There is a slowdown in aggregate demand especially from the consumer. This will both help to slow demand driven inflation rate and help support the RBA in interest rate cut decisions.

On the flip side there are concerns still about strong unit labour cost growth that are likely to delay any rate cut decisions.

Stock Highlight

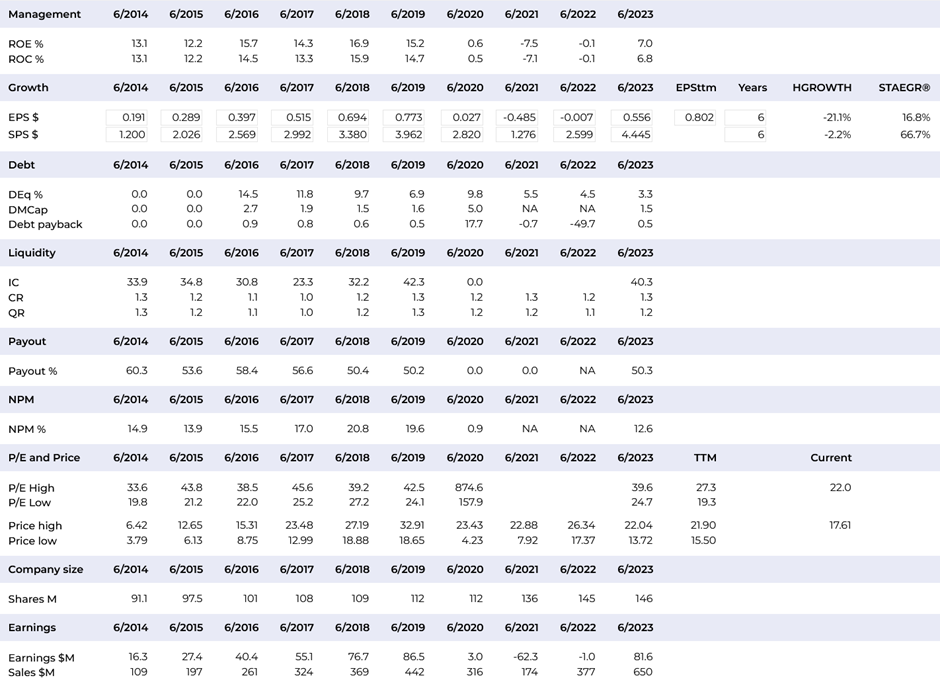

Corporate Travel Management Ltd (ASX: CTD)

Corporate Travel Management Ltd (ASX: CTD) provides travel services for corporate customers across the Americas, Australia and New Zealand, Europe, and Asia. Its services include business, events, leisure, loyalty, and wholesale travel.

The company has built scale and breadth through both organic growth and acquisitions. Corporate Travel is among the world's five largest corporate travel management companies.

The company derives the vast majority of its revenue from its North American segment. Corporate Travel Management reports its business is significantly larger than before the COVID-19 pandemic hit its operations.

Financial data:

Shareholder updates

Multimedia Technology (MMT)

Multimedia Technology (MMT) has recently entered into a strategic distribution agreement with Vertiv, a leading provider of critical digital infrastructure and continuity solutions. This partnership is poised to significantly enhance the IT landscape in Australia by granting MMT’s extensive network of over 5,300 channel partners access to Vertiv’s comprehensive range of products. These include cutting-edge single-phase uninterruptible power supply systems, precision cooling, rack solutions, and innovative self-contained data centres like the Vertiv SmartCabinet 2-M and Vertiv SmartRow2, designed specifically for edge computing applications.

Johan Meyer, CEO at MMT, highlights the rapid advancements in AI technology and the crucial need for reliable infrastructure to support it, emphasising the importance of uninterrupted power and effective cooling. The collaboration with Vertiv stands as a testament to MMT's commitment to bolstering its IT capabilities and providing holistic solutions to its partners, focusing on alleviating common hardware procurement challenges and enhancing AI specialisation and SME support.

Vertiv’s ANZ Sales Director, LuLu Shiraz, sees the alignment with MMT’s solutions as a natural fit, aiming to fortify their standing in the industry through this customer-centric partnership. Together, MMT and Vertiv are set to redefine support for IT and AI workloads, meeting the growing demands of the sector with expertise and innovation.

Teaminvest Access Fund

The unit prices for February 2024:

|

15th February 2024 |

$0.9437 |

|

29th February 2024 |

$0.9479 |

Fund Information

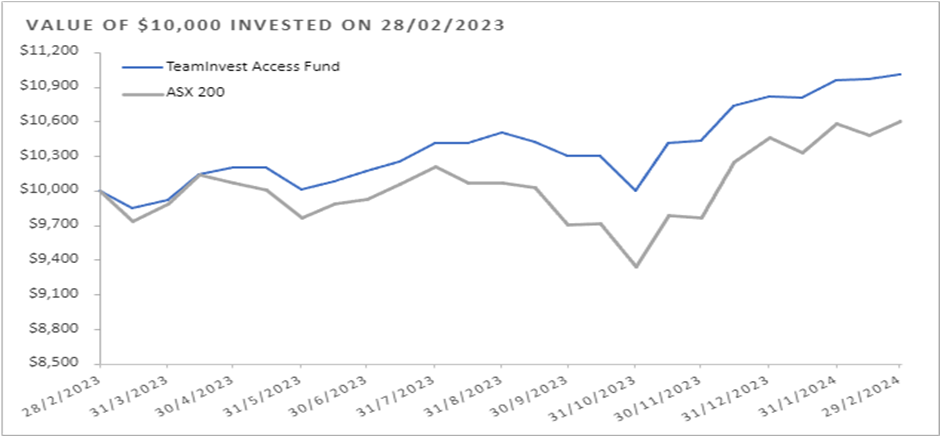

The TeamInvest Access Fund has shown growth over the past year compared to the ASX 200.

For an investment of $10,000 as at 28 February 2023, your current value with:

- Teaminvest Access Fund would be $11,009.00

- ASX -200 would be $10,606.6

The top 5 performing stocks within the TeamInvest Access Fund for February are highlighted below:

|

Share Code |

Share Name |

Return from 31/01/2024 to 29/02/2024 |

|

CDA |

Codan Ltd |

26.30% |

|

ARB |

ARB Corporation Ltd |

22.24% |

|

NCK |

Nick Scali Limited |

17.95% |

|

CCP |

Credit Corp Group Ltd |

11.50% |

|

CAR |

Car Group Limited |

11.36% |

Next Statement

The next Statement to be issued will be the Quarterly Statement for the period 01 January 2024 to 31 March 2024. This Statement should arrive in your email inbox the week beginning 8 April 2024.

If you haven't received any statements recently, please check your spam folder. Statements are also found within your Investor Portal.

Investor Portal

You can access your investor portal at any time using the following link: https://investors.tipgroup.com.au/py/sys.pyc OR

You can now access your Investor Portal via the TIP Website:

Financial Services | TIP Group

AND clicking on Investor Portal in the headings section

Contact Us

Our Funds Administration Team are here to assist.

(P): 1300 160 803

(E): funds@tipgroup.com.au

*Past performance is not indicative of future performance

Private Equity Fund

Unlocking Australia’s $50 Billion Economic Boost: The Private Equity-Led Manufacturing Renewal

In the post-COVID-19 landscape, Australia’s manufacturing sector stands on the brink of a pivotal resurgence. Traditionally viewed as just another economic component, manufacturing has emerged as the backbone of innovation and self-sufficiency—especially as the pandemic underscored the critical nature of domestic production capabilities. With Australia ranking last in manufacturing self-sufficiency among OECD countries, the call for a strategic overhaul is loud and clear. This is where private equity steps in, poised to play a transformative role.

Private equity offers the financial muscle and strategic acumen necessary to rejuvenate Australia’s manufacturing base. By infusing capital and expertise into this sector, private equity promises not only to revitalise operations and facilitate technological advancements but also to steer firms towards high-value production and global competitiveness. The potential economic boost is staggering, with a forecasted $50 billion uplift that spells jobs, innovation, and resilience.

The manufacturing sector isn’t merely another industry; it’s a rich tapestry of opportunities for high-quality, full-time employment and a linchpin of global trade. As Australia navigates its post-pandemic recovery, private equity stands ready to fuel this manufacturing revival, championing a future of economic strength and innovation.

This investment isn’t just about profit—it’s a strategic move towards securing Australia’s economic future, making the private equity-led manufacturing renewal a cornerstone of Australia’s roadmap to recovery and prosperity.

Learn more about our Private Equity Fund

*Past performance is not indicative of future performance

Future Property Fund

Revolutionising High Street Windsor: A New Dawn Begins

As demolition nears completion, the Windsor Project marks a significant milestone in transforming the iconic 196 – 206 High Street Windsor into a beacon of modern commerce and community.

Spearheaded by the visionary collaboration between Chapter Group and Taronga Group, this ambitious endeavor will see the former John Blair Honda site reborn as a cutting-edge, 6-storey retail and commercial office building. With both developers renowned for their commitment to innovation and excellence, this development promises to redefine Windsor's skyline and energise the local economy.

Stay tuned as we continue to reimagine High Street, shaping a dynamic future for Windsor and see the demolition progress:

Corinthian Balanced Fund

February 2024 Update

- As of 29 February 2024, the unit price of the CBF was $1.071, with a performance of 0.86% for the month and 6.92% financial year-to-date.

- The CBF has a total portfolio value of $65,021,394 with growth assets accounting for $28,281,384 (43.5%) and defensive assets accounting for $36,740,010 (56.50%).

- For February we continued strategic investments in Australian shares (circa $1 mil) and commercial debt (circa $3mil).

- Stock markets rose again with the ASX200 rising 0.8% and the S&P500 rising 5.17%.

Unit Price

- The financial year starting unit price for the CBF was $1.00166 (ex-distribution price).

- The 29 February 2024 unit price is $1.0710.

- The performance for the month of February was 0.86%

- Financial YTD performance is 6.92% (for 8 months to 29 February)

The Unit price is calculated in accordance with the Constitution and is based on the value of the underlying assets of the Fund with an adjustment for any relevant Transaction Costs.

*Past performance is not indicative of future performance

Conscious Investor Fund

Welcome to the interim Letter for members of the Conscious Investor Fund, families and friends:

Over the past 12 months the performance of the Fund was 16.29%. Since inception, the investments of our early Members have tripled in value since they were first deposited. (You can see this in the growth chart in the Report.)

The Letter also takes a deep dive into Alphabet (Google) one of our largest holdings: what drives it with the sort of success that makes it likely we will want it to be a key holding for many years to come. Since 2015 the Fund has purchased 22 parcels of Alphabet shares for a current holding of 52,000 shares for a total value of AUD$11.6 million. This means an average annual return of 23.18% since the first purchase.

We also look at some of the penetrating remarks and quips by Charlie Munger, Warren Buffett’s late friend and partner, who passed away in December last year at age 99 years.

We wish health and wealth for you and your family for 2024. Let us know if you have any questions.

From John Price and Members of the Capital Allocation Team.

Dr John Price

Conscious Investor Fund

Conscious Investor Fund

Conscious Investor Fund

Want to read another story?

Back to menu

TiP Group Newsletter, March 2024